Closing Costs when Buying a home in Nova Scotia

Closing Costs when Buying A home in Nova Scotia

There are many expenses related to Closing Costs when Buying a home in Nova Scotia. Most people know that they require a down payment, however, this is only one of many costs related to buying.

🏡 Closing Costs When Buying a Home in Nova Scotia

Closing Costs When buying a Home In Nova Scotia

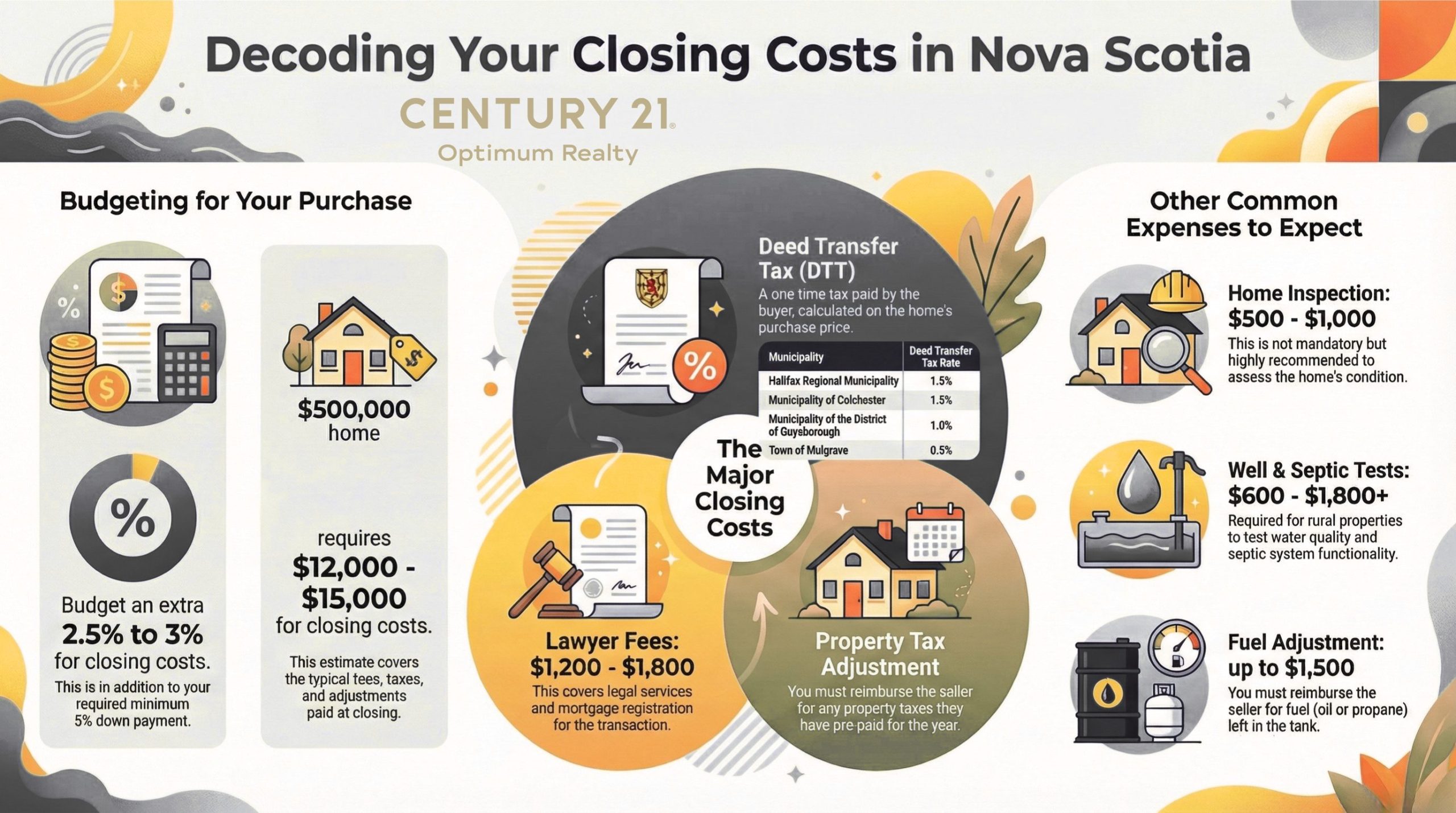

When purchasing a home in Nova Scotia, it's essential to budget for more than just the purchase price. Closing costs can add up, and a good rule of thumb is to set aside approximately 2.5-3% of the purchase price to cover these expenses.

For example, on a $500,000 home, you should budget about $12,000 - $15,000+/- for closing costs.

Here's a detailed breakdown of what to expect:

💼 1. Lawyer Fees

- Legal fees for buying a home typically range from $1,000 to $1,500

- Additional costs, such as mortgage registration (about $75), bring the total to approximately $1,200 to $1,800

- For a list of lawyers, visit the Nova Scotia Barristers' Society at www.nsbs.org

💰 2. Property Taxes

- Property taxes are paid every October and April

- At closing, there will be an adjustment based on the time of year and the property's tax amount

- Example: If annual property taxes are $2,400, $1,200 is paid in April and $1,200 in October. If you close in May, you reimburse the seller for about five months of taxes (approximately $1,000) and then prepare for your October payment

- Most lenders manage property tax payments for you

- More information is available at www.halifax.ca

📝 3. Deed Transfer Tax (DTT)

The Deed Transfer Tax is a one-time fee paid by the buyer at closing, calculated as a percentage of the purchase price or assessed value (whichever is higher). Each municipality in Nova Scotia sets its own rate, usually between 0.5% and 1.5%.

Example: In Halifax Regional Municipality (HRM), the rate is 1.5%, so a $500,000 home would incur a $7,500 DTT, collected by your lawyer and paid to the municipality.

Deed Transfer Tax Rates by Municipality

| Municipality/Community | Deed Transfer Tax Rate |

|---|---|

| Halifax Regional Municipality | 1.5% |

| Municipality of the County of Annapolis | 1.5% |

| Town of Annapolis Royal | 1.5% |

| Town of Middleton | 1.5% |

| Municipality of the County of Antigonish | 1.0% |

| Town of Antigonish | 1.5% |

| Cape Breton Regional Municipality | 1.5% |

| Municipality of Colchester | 1.5% |

| Town of Stewiacke | 1.0% |

| Town of Truro | 1.5% |

| Municipality of the District of Guysborough | 1.0% |

| Municipality of the District of St. Mary's | 1.25% |

| Town of Mulgrave | 0.5% |

Rates are subject to change. Always confirm with the municipality before your transaction.

⚠️ Non-residents: As of April 1, 2025, non-residents must pay an additional 10% Provincial Deed Transfer Tax on residential properties with three or fewer units, unless they move to Nova Scotia within six months of purchase.

🔍 4. Home Inspection

- Not mandatory, but highly recommended

- Inspections reveal the home's condition and any issues to address before closing

- Budget $500–$1,000 for a home inspection

- Find inspectors at www.cahpi-atl.com/node/3/nova%20scotia/list

🏦 5. Mortgage Application Fees

- Some lenders charge fees for mortgage applications and appraisals

- If borrowing more than 80% of the property's value, expect fees of about $300–$400, paid at application

⛽ 6. Fuel Adjustment

- If the home uses oil heat, budget $1000–$1500 for a full tank, which is typically filled by the seller before closing and reimbursed by the buyer

- For propane, a full tank can cost $400–$800 depending on size and market price

💧 7. Water Quality and Quantity Tests

- Required if the property is on a well

- Water quality tests (for bacteria, arsenic, uranium) cost about $200–$500

- Flow rate (quantity) tests, while optional, are recommended and cost $250–$500

🚿 8. Septic Field Test

- If the property has a septic system, a dye test and visual evaluation are advisable

- Expect to pay about $400-$800 for this service

📦 9. Miscellaneous Costs

- Include moving expenses, utility hookups, new appliances, blinds, curtains, etc.

In summary: Budgeting for closing costs is a vital part of the home buying process in Nova Scotia. Understanding the deed transfer tax rates in your municipality and working with experienced professionals will help ensure a smooth transaction. Always confirm the latest rates and requirements with your lawyer or real estate agent before closing.