Canadian Mortgage Delinquency Rates in 2025: What Borrowers Need to Know

By Rob Lough, Broker/Owner at Century 21 Optimum Realty

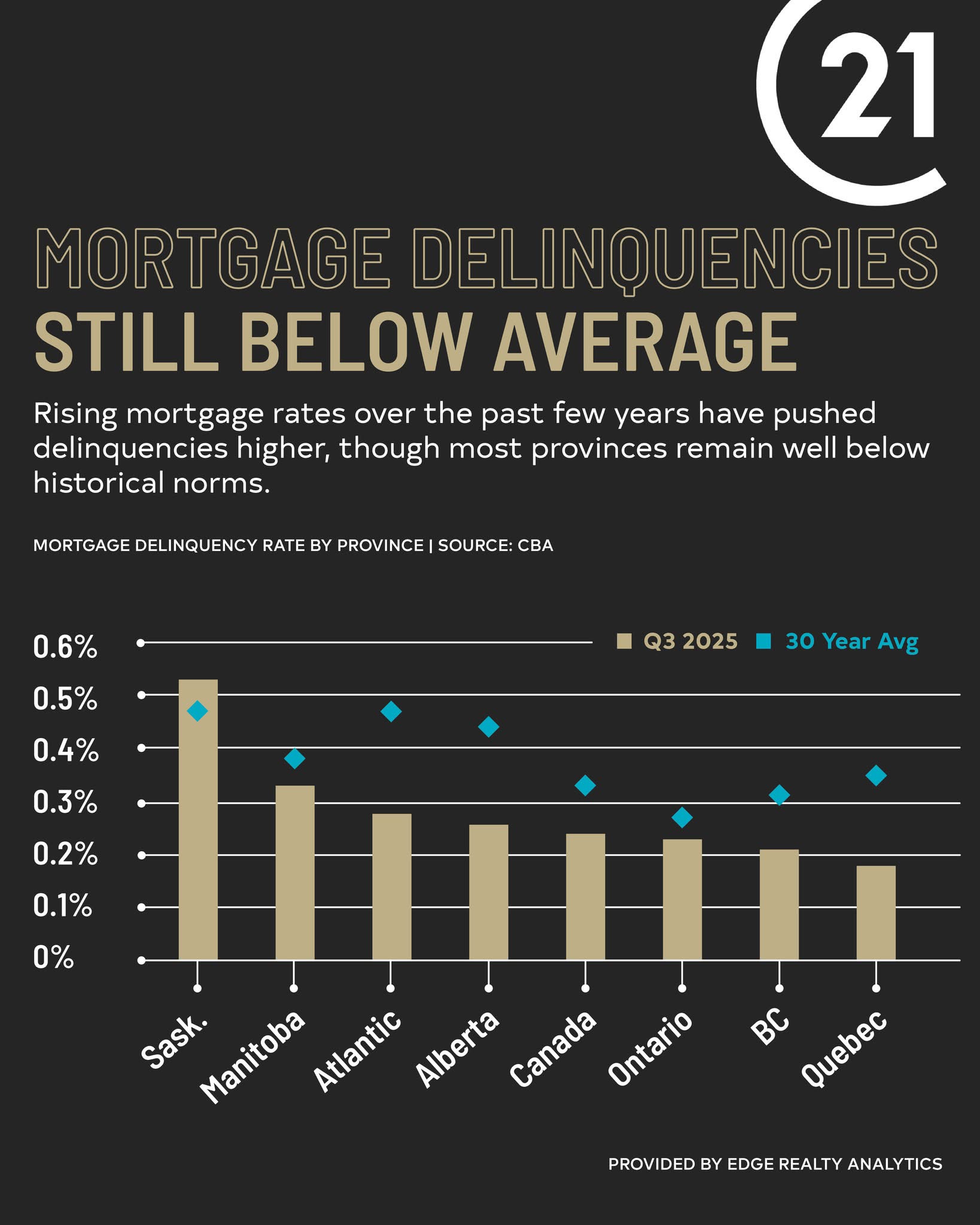

Mortgage delinquency rates across Canada have been quietly climbing as households continue absorbing the impact of past interest rate hikes. Yet despite the upward trend, arrears remain remarkably low by historical standards—a sign that homeowners are prioritizing their mortgage payments even as other financial pressures mount.

For buyers, sellers, and current homeowners in Nova Scotia and beyond, understanding where delinquency rates stand today—and how lenders are responding—offers important context about the stability of Canada’s housing market heading into 2025.

Where Mortgage Delinquency Rates Stand in 2025

Canada’s national mortgage delinquency rate (defined as mortgages 90 or more days in arrears) sat at approximately 0.21% to 0.22% in late 2024 and mid-2025. That’s up from roughly 0.17% to 0.19% a year earlier, representing a modest increase as higher borrowing costs work their way through the system.

To put that in perspective, these rates remain below pre-pandemic norms. In 2019, national mortgage arrears were closer to 0.28%, and current levels are nowhere near the distress seen during past housing or employment downturns when delinquencies spiked well above 0.4%.

Early-stage delinquencies—borrowers just starting to miss payments—are ticking upward, and renewal-related “payment shock” is becoming more common as mortgages renew at higher rates. That suggests arrears could drift higher in the months ahead, but from a very low baseline that leaves considerable room before reaching crisis territory.

Provincial Differences: Who’s Feeling the Most Pressure

Mortgage stress isn’t distributed evenly across the country. Some provinces are experiencing notably higher delinquency rates, while others remain near historic lows.

Saskatchewan currently posts the highest mortgage delinquency rate among Canadian provinces at approximately 0.37% in Q1 2025—nearly double the national average. Economic headwinds in resource-dependent regions have contributed to elevated stress levels.

Manitoba also sits above the national rate, though still well below 1% in absolute terms.

Ontario reported a 90+ day delinquency rate of 0.27% in Q2 2025, up from prior years but still below past-cycle highs. Given Ontario’s massive share of national mortgage volume, even modest percentage increases here carry weight.

British Columbia clocked in at 0.19% in Q2 2025—modestly above recent lows but close to the national average. Despite Vancouver’s reputation for housing volatility, BC’s mortgage arrears remain relatively contained.

Quebec continues to post below-average mortgage delinquency rates. While household financial stress is evident in non-mortgage credit products, the mortgage side remains comparatively stable across the province.

Provincial Mortgage Delinquency Snapshot

| Province | Recent Delinquency Rate | Relative to National Norm |

|---|---|---|

| Saskatchewan | ~0.37% (Q1 2025) | Above long-term and national averages |

| Manitoba | Above national average | Elevated vs. peers, still low in absolute terms |

| Ontario | 0.27% (Q2 2025) | Up from prior years, below past-cycle highs |

| British Columbia | 0.19% (Q2 2025) | Modestly above recent lows, close to national average |

| Quebec | Below national average | Mortgage side remains stable despite non-mortgage stress |

Across most regions, delinquency rates remain below their own long-term averages, underscoring the cushion that exists before conditions would resemble a true mortgage crisis.

How Lenders Are Supporting Borrowers

One reason mortgage arrears haven’t spiked more dramatically is the proactive approach many lenders have taken to help struggling borrowers stay current.

Federal guidance encourages banks and credit unions to offer relief options rather than pushing borrowers straight into default. These measures include:

- Term extensions that spread payments over a longer amortization period

- Temporary payment relief to bridge short-term cash flow challenges

- Interest-only payment periods for borrowers facing temporary income disruptions

- Proactive outreach ahead of renewals to stress-test new payment levels and restructure where necessary

Industry reports indicate many institutions are contacting borrowers well before their renewal dates, identifying those at risk of payment shock, and offering customized solutions. This collaborative approach helps cap how quickly formal delinquencies and foreclosures rise, even as economic pressures persist.

For homeowners approaching renewal, this environment creates an opportunity to engage with your lender early, explore options, and avoid letting temporary stress turn into long-term damage.

The Bigger Picture: Household Stress vs. Mortgage Resilience

While mortgage delinquency rates remain low, other indicators reveal mounting financial pressure across Canadian households.

Consumer insolvency filings reached approximately 137,000 in 2024—the highest level since 2019 and above the 10-year average. Rising living costs, elevated debt servicing burdens, and stagnant wage growth have pushed more Canadians toward formal insolvency proceedings.

Critically, non-mortgage credit is showing much higher delinquency rates than mortgages. Credit cards, lines of credit, and auto loans are seeing significantly elevated arrears, suggesting many households are prioritizing their mortgage payments above all else and falling behind elsewhere.

This pattern reinforces a key insight: homeowners are doing everything they can to keep their housing secure. The home remains the financial priority, even when it means sacrificing other areas of household budgets or accumulating stress in unsecured debt.

That dynamic helps explain why mortgage arrears remain contained even as broader consumer credit metrics flash warning signs.

What This Means for Canadian Homeowners

The current mortgage landscape presents a nuanced picture. Delinquency rates are rising, but from historically low levels. Payment shock at renewal is real, but lenders are offering pathways to manage it. Household finances are strained, but mortgage defaults remain rare.

For current homeowners: If you’re approaching renewal or struggling with payments, reach out to your lender early. Relief options exist, and banks have strong incentives to work with you rather than foreclose. Protecting your home may require short-term sacrifices in other spending areas, but the data shows most borrowers are successfully navigating that trade-off. Understanding your GDS vs TDS ratios can help you assess your current financial position and prepare for renewal conversations.

For prospective buyers: Low delinquency rates and proactive lender support suggest the housing market remains fundamentally stable. While affordability challenges persist, the risk of widespread foreclosures or a mortgage crisis remains low. Understanding your borrowing capacity, planning for potential rate changes, and maintaining financial flexibility remain critical. Working with professionals who understand how bank appraisals differ from CMAs can also help you navigate the home buying process with confidence.

For those considering selling: Market stability cuts both ways. While low delinquency rates mean fewer distressed sales and competing inventory, they also indicate that most homeowners are holding onto their properties rather than being forced to sell. In markets like Halifax and across Nova Scotia, inventory constraints continue shaping pricing dynamics.

A Nova Scotia Perspective

Nova Scotia’s mortgage market largely mirrors national trends, with delinquency rates remaining low even as some borrowers face renewal challenges. Halifax Regional Municipality, East Hants, and Truro continue to benefit from strong population growth and steady housing demand, factors that support property values and give homeowners equity cushions against temporary financial stress.

The region’s robust housing construction activity—with Halifax housing starts jumping 32% year-over-year—demonstrates continued market strength and developer confidence. Meanwhile, initiatives like HRM’s Suburban Housing Accelerator are reshaping development patterns and creating new housing options across price points.

Local lenders in the region have adopted the same proactive approach seen nationally, offering restructuring options and working with borrowers ahead of renewals. For homeowners in Nova Scotia facing payment pressures, that local support network—combined with strong underlying market fundamentals—provides meaningful protection against default.

As always, buyers and sellers navigating Nova Scotia’s housing market should work with experienced local professionals who understand both regional dynamics and the broader economic context shaping mortgage conditions across the country.

Looking Ahead

Canada’s mortgage delinquency rates will likely continue edging higher in 2025 as more borrowers renew at elevated rates and economic uncertainty persists. However, the combination of low absolute arrears levels, substantial lender flexibility, and homeowners’ demonstrated commitment to prioritizing mortgage payments suggests the risk of a sharp deterioration remains limited.

The story isn’t one of crisis—it’s one of resilience under pressure, with both borrowers and lenders adapting to a higher-rate environment while maintaining fundamental housing market stability.

Related Resources:

- GDS vs TDS Ratios: Your Complete Guide to Canadian Mortgage Qualification

- Bank Appraisal vs Real Estate CMA in Nova Scotia: Complete Guide for Homeowners

- Halifax Housing Starts Jump 32% Year-Over-Year

- Understanding HRM’s Suburban Housing Accelerator

Have questions about your mortgage situation or how market conditions affect your buying or selling plans? Contact Rob Lough at Century 21 Optimum Realty for personalized guidance tailored to Nova Scotia’s housing market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link