Bank of Canada Holds Overnight Rate at 2.25%: What It Means for Nova Scotia’s Housing Market

By Rob Lough, Broker/Owner at Century 21 Optimum Realty | April 2025

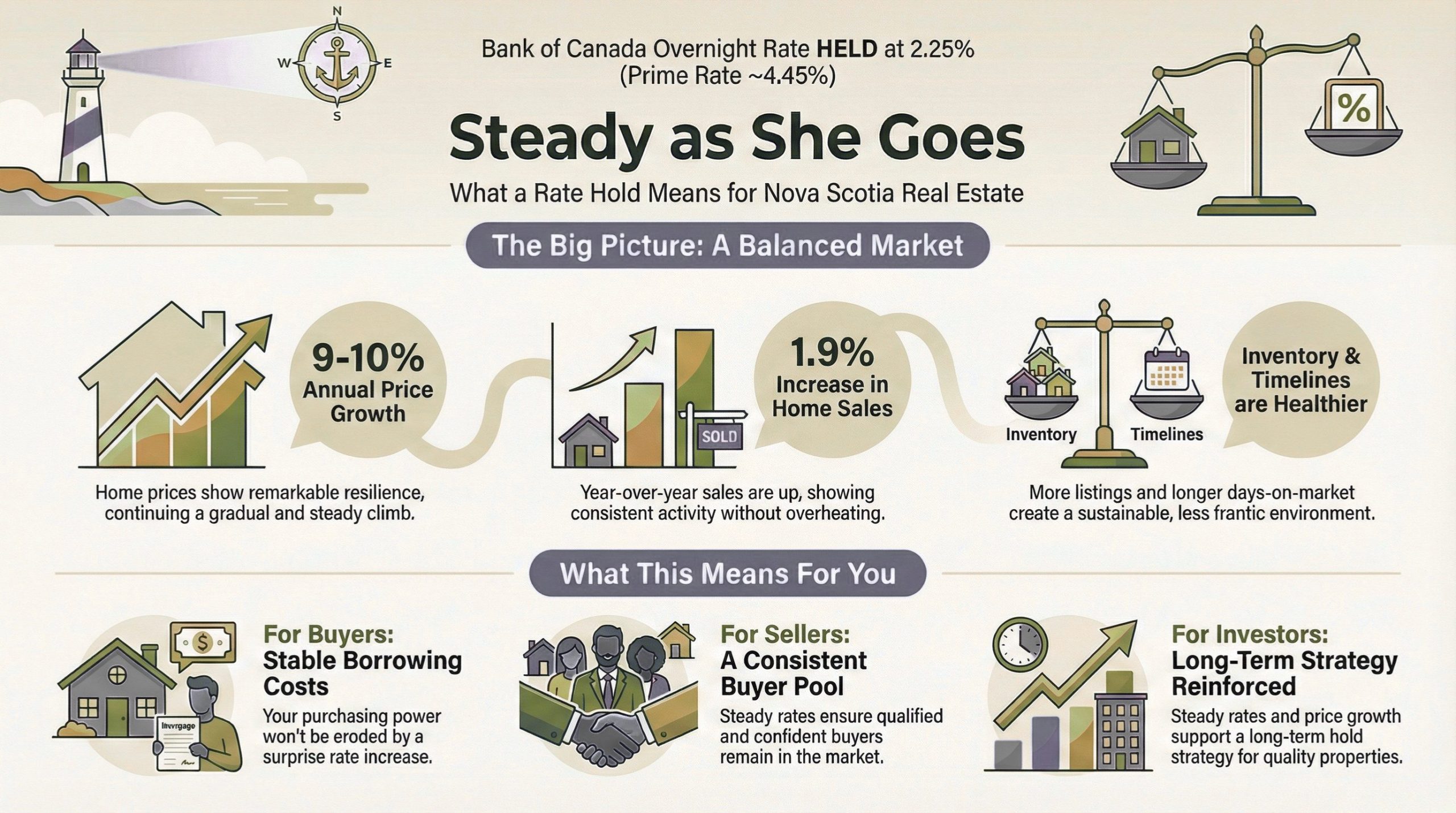

When the Bank of Canada announces a rate hold, it might seem like non-news at first glance. But for buyers, sellers, and investors in Nova Scotia’s real estate market, a decision to keep the overnight rate at 2.25% (and prime around 4.45%) carries important implications for the weeks and months ahead.

Markets had broadly anticipated this hold, and the decision reinforces the current trajectory of our housing market rather than changing its course. Here’s what that means for you.

Borrowing Costs Stay Steady

With the overnight rate unchanged, variable-rate mortgage holders and anyone carrying a home equity line of credit (HELOC) won’t see an immediate shift in their monthly payments. Prime rate remains around 4.45%, which means your borrowing costs stay exactly where they’ve been.

For buyers: This doesn’t represent an improvement in affordability, but it does provide stability. You can move forward with your homebuying plans knowing that your purchasing power won’t be eroded by a surprise rate increase.

For current homeowners: Variable-rate mortgage payments remain predictable for now, giving you breathing room to plan your budget or consider whether refinancing to a fixed rate makes sense for your situation.

Demand Remains Cautiously Active

Nova Scotia’s housing market has been operating in a moderate but positive gear throughout early 2025. March sales were up approximately 1.9% year-over-year, showing consistent activity without the frenzied pace we saw during the pandemic years.

A rate hold means we’re likely to see more of the same: steady buyer interest, qualified purchasers in the market, and continued movement of well-priced listings. The market isn’t overheating, but it’s far from stalling either.

This balanced environment is healthy for both buyers and sellers, creating opportunities for negotiation while maintaining reasonable transaction timelines.

Prices Continue Gradual Climb

Despite higher interest rates compared to 2020-2021, Nova Scotia home prices have shown remarkable resilience. We’re seeing annual price growth in the 9–10% range across the province, with Halifax’s aggregate price trending upward and new home prices climbing approximately 4.6–4.8% year-over-year.

A rate hold supports continued gradual appreciation rather than triggering a sudden surge. For sellers, this means pricing your home appropriately for current market conditions will continue to attract motivated buyers. For buyers, it reinforces the importance of acting when you find the right property rather than waiting for prices to drop significantly.

Understanding property assessments becomes increasingly important in this environment, as assessed values help inform both listing prices and buyer expectations.

Inventory and Days-on-Market Remain Balanced

One of the most significant shifts we’ve seen post-pandemic is the return to more balanced inventory levels. Listings have been building, and average days-on-market are longer than the bidding-war frenzy of 2021-2022.

This doesn’t signal a weak market—rather, it indicates a healthier, more sustainable environment where buyers have time to make informed decisions and sellers can still achieve strong results with proper pricing and marketing.

No change from the Bank of Canada should keep this balance intact as we move deeper into the spring market. Expect inventory to continue its seasonal climb while absorption rates remain steady.

The Psychological Impact of “Steady as She Goes”

Perhaps the most underestimated effect of a rate hold is its psychological impact on market participants. When the Bank signals it’s comfortable with current rate levels, it sends a message that the economy is performing roughly as expected—not overheating, not falling into recession.

For buyers, this removes the urgency of “rate panic,” allowing more deliberate decision-making. For sellers, it provides reassurance that the qualified buyer pool won’t suddenly evaporate due to affordability shocks.

This psychological stability tends to support consistent transaction volume rather than the boom-bust cycles we’ve sometimes seen in the past.

What This Means for Different Market Participants

For Homebuyers

Today’s decision keeps variable-rate products and prime-based lending stable. While affordability hasn’t dramatically improved from last month, you can plan your purchase with greater confidence because the Bank has signaled it’s comfortable with the current level of rates.

If you’re currently working on mortgage pre-approval, this stability allows you to move forward knowing your borrowing capacity won’t shift unexpectedly in the near term. Focus on finding the right property rather than trying to time rate movements.

For Home Sellers

Steady rates support a consistent pool of qualified buyers. With Nova Scotia prices still trending upward and inventory higher but not excessive, well-priced listings should continue to move at reasonable timelines.

Spring traditionally brings increased buyer activity to the market, and the rate hold reinforces that seasonal pattern rather than disrupting it. Make sure your listing strategy accounts for current market conditions rather than outdated pricing from the pandemic era.

For Real Estate Investors

Cash-flow calculations don’t change overnight with this decision. However, the combination of steady rates and ongoing population and price growth in Halifax and across Nova Scotia continues to support a long-term hold strategy for quality investment properties.

If you’re considering adding to your portfolio, understand that new mortgage qualification rules for investment properties are taking effect, which may impact your purchasing strategy regardless of rate movements.

Looking Ahead: What to Watch

While today’s hold maintains the status quo, the Bank of Canada will continue monitoring economic indicators including inflation, employment, and GDP growth. Future rate decisions will depend on how these factors evolve.

For Nova Scotia’s housing market, the key variables to watch include:

- Population growth: Continued immigration and interprovincial migration support housing demand

- Inventory levels: Seasonal patterns and new construction will influence market balance

- Employment trends: Job market strength directly impacts buyer confidence and qualification

- National economic indicators: What happens in the broader Canadian economy affects local markets

The provincial government’s housing initiatives, including developments and ongoing infrastructure investments, will also play a role in shaping supply and demand dynamics regardless of interest rate movements.

The Bottom Line

A Bank of Canada rate hold at 2.25% doesn’t represent a dramatic market shift, but rather validation of the current trajectory. For Nova Scotia’s housing market, that means:

- Steady borrowing costs maintaining current affordability levels

- Continued moderate sales activity with year-over-year growth

- Gradual price appreciation rather than sudden spikes or drops

- Balanced inventory conditions supporting both buyers and sellers

- Psychological stability encouraging informed decision-making

Whether you’re planning to buy, sell, or invest in Nova Scotia real estate, the key takeaway is this: market fundamentals remain healthy, and well-informed decisions based on your personal circumstances will serve you better than trying to time rate movements.

If you have questions about how today’s announcement affects your specific real estate plans, I’m here to help you navigate the market with clarity and confidence.

About the Author

Rob Lough is a Broker/Owner/Realtor® at Century 21 Optimum Realty with 25 years of experience in Nova Scotia real estate. Serving Halifax Regional Municipality, East Hants, and Truro markets, Rob combines deep local market knowledge with practical guidance for buyers, sellers, and investors.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link