Halifax-Dartmouth Real Estate Market Stats January 2026

By Rob Lough, Broker/Owner – Century 21 Optimum Realty Published: February 2026

The first month of 2026 is in the books, and the Halifax-Dartmouth real estate market is telling an interesting story. While January is always a quieter month in Nova Scotia, this year’s numbers reveal a market that’s shifting gears and both buyers and sellers need to pay attention.

If you want more background on what’s been driving Nova Scotia prices, affordability, and financing over the past couple of years, you may also like my articles on Nova Scotia’s housing affordability crisis and new mortgage rules for 2024 & 2025. Curious how the Halifax/Dartmouth Market did during the 2025 year, check out our 2025 year end summary.

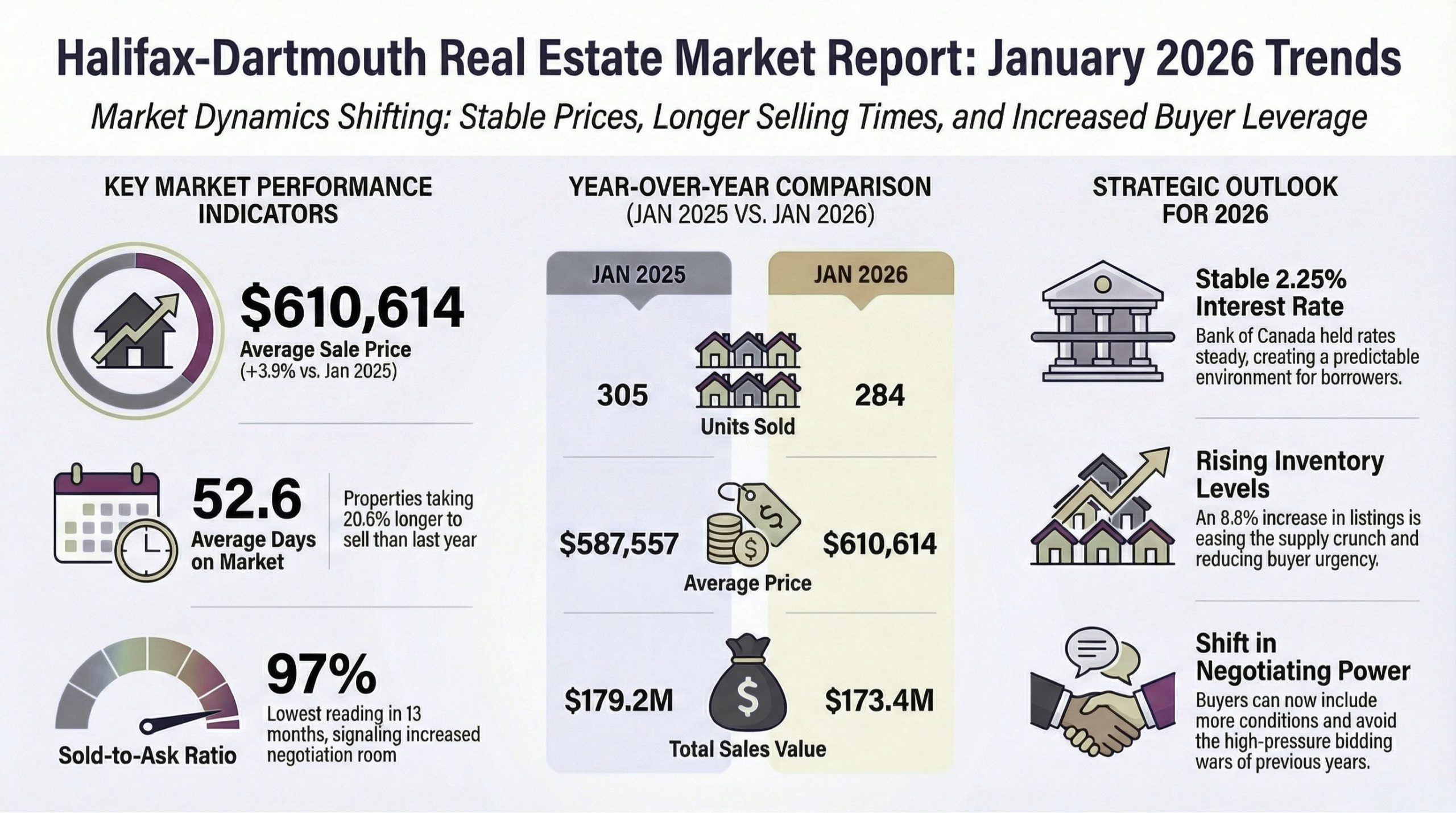

Here’s a full breakdown of the January 2026 market stats for the Halifax-Dartmouth region (not including vacant land).

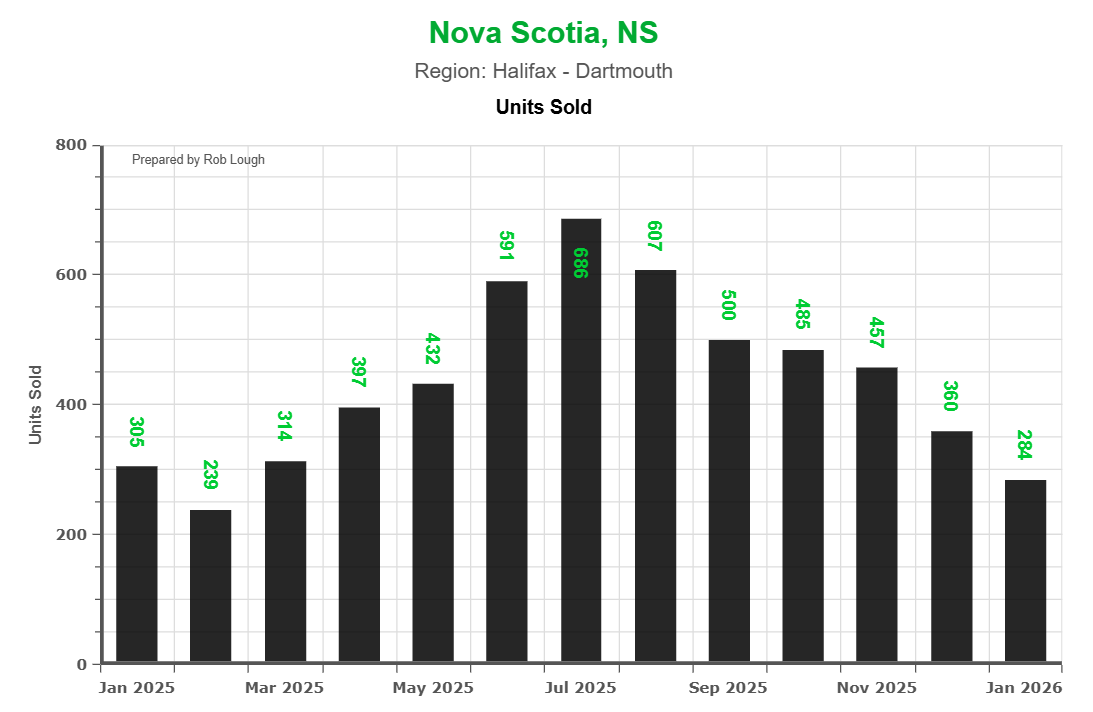

Units Sold: A Seasonal Slowdown

Halifax-Dartmouth recorded 284 residential sales in January 2026, down from 360 in December and 305 in January 2025. That represents a 6.9% year-over-year decline in transaction volume.

Number of Units Sold Halifax-Dartmouth Real Estate Market Stats – January 2026

This dip isn’t surprising. January is historically the slowest month of the year in our market, and holiday fatigue combined with winter weather tends to keep both buyers and sellers on the sidelines. The bigger picture shows a market that ramped up significantly through the spring and summer — peaking at 686 units in July 2025 — before settling back into seasonal patterns through the fall and winter months.

If you’re thinking about buying a home in Halifax, the reduced competition right now could work in your favour.

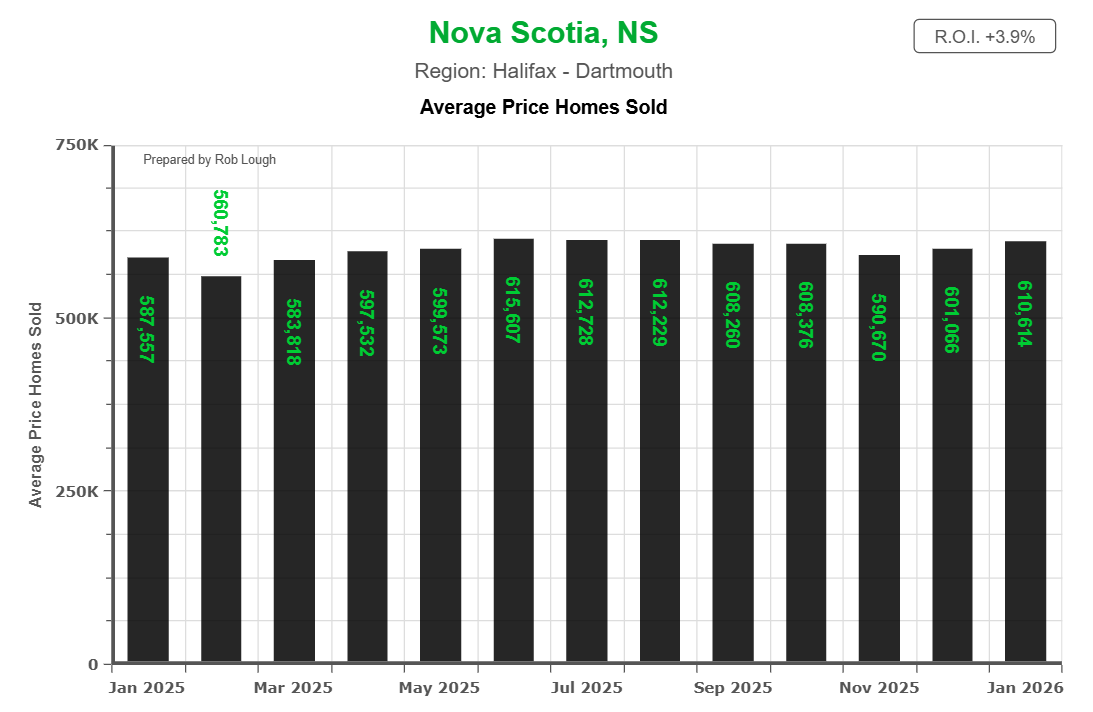

Average Sale Price: Steady Growth Year Over Year

The average sale price for homes in Halifax-Dartmouth came in at $610,614 in January 2026. That’s up 3.9% compared to January 2025, when the average was $587,557.

Average Price of Sold Homes Halifax-Dartmouth Real Estate Market Stats – January 2026

Prices have remained remarkably stable throughout the past year. After dipping slightly to $560,783 in February 2025, values climbed steadily through the spring and held in the $590,000–$615,000 range for most of the second half of the year. The January 2026 figure of $610,614 sits comfortably in line with the 12-month trend, suggesting steady, not explosive, appreciation.

For sellers, this is reassuring. Your home’s value hasn’t slipped despite the seasonal slowdown. For buyers, the 3.9% annual return on investment reinforces that real estate in Halifax-Dartmouth continues to be a solid long-term play; if you want to understand how lenders view value, my guide on bank appraisals vs. real estate CMAs in Nova Scotia is a useful companion read.

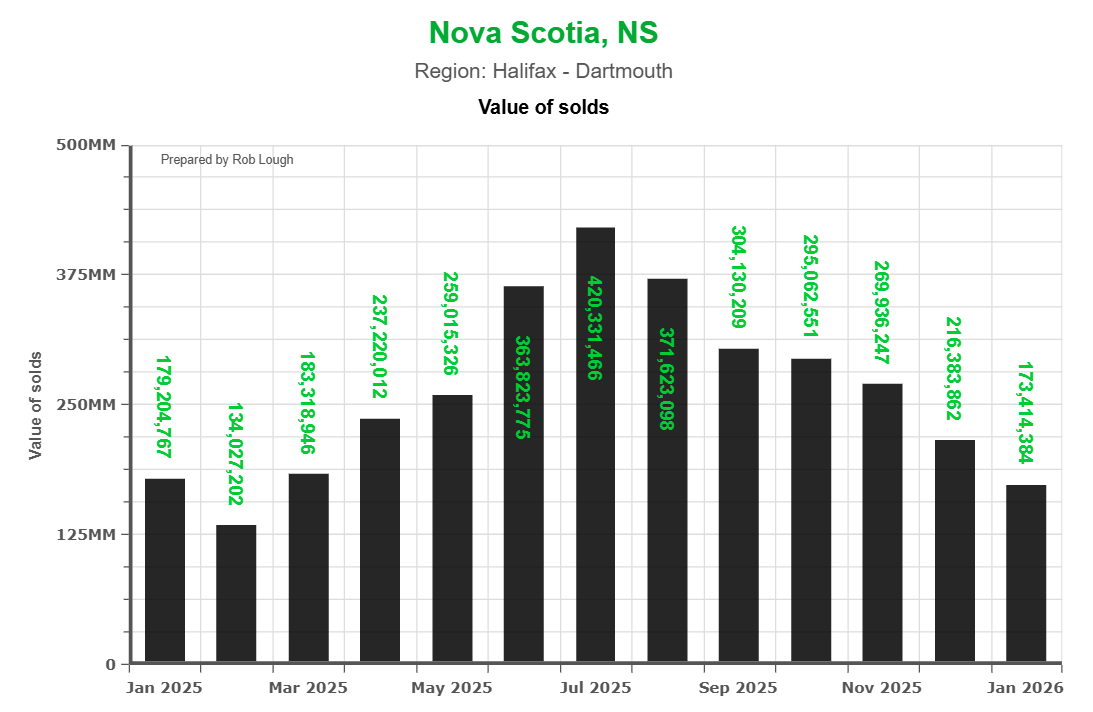

Total Value of Sales: Reflecting the Seasonal Dip

The total dollar value of homes sold in January 2026 was $173,414,384. That’s down from $216,383,862 in December and $179,204,767 in January 2025 — a 3.2% year-over-year decline.

Value of Sold Homes Halifax-Dartmouth Real Estate Market Stats – January 2026

This metric tracks closely with units sold. Fewer transactions naturally mean less total dollar volume, even when prices hold firm. The summer peak of $420,331,466 in July 2025 feels like a distant memory, but the seasonal pattern here is completely normal for our region.

If you’re watching broader policy and affordability pressures that feed into these numbers, my deep dive on Nova Scotia’s housing affordability crisis offers more context.

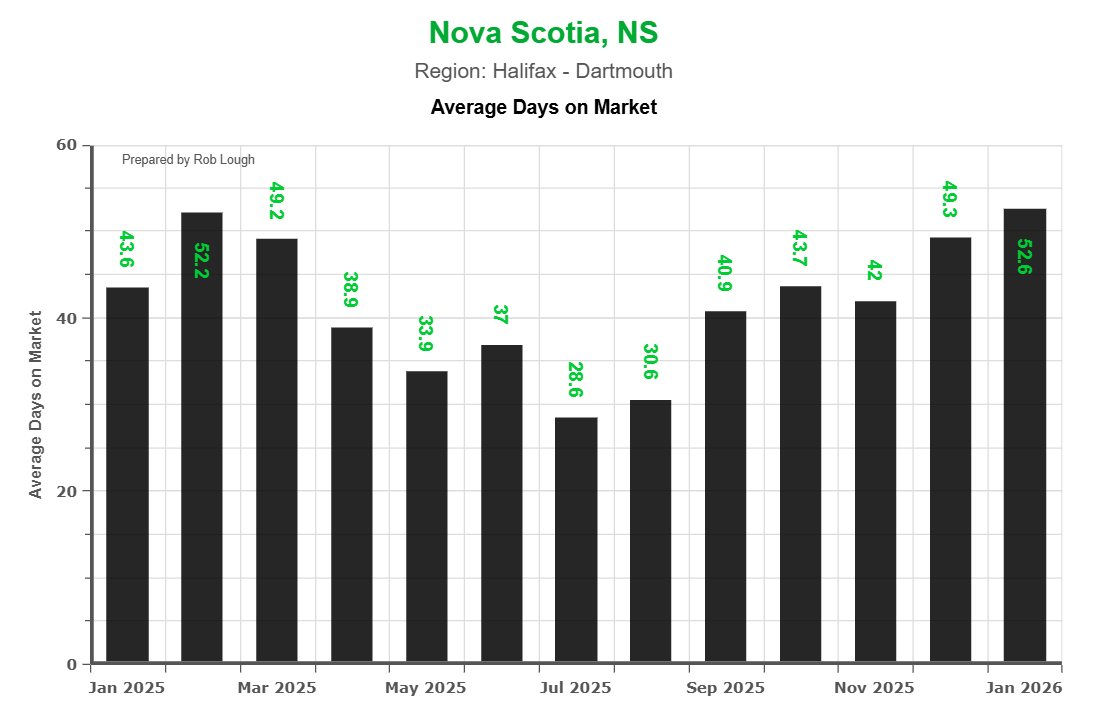

Average Days on Market: Homes Are Taking Longer to Sell

One of the most notable shifts in January’s data is the average days on market, which climbed to 52.6 days. That’s up from 49.3 in December and significantly higher than January 2025’s 43.6 days, a 20.6% year-over-year increase.

Average Days on Market Halifax-Dartmouth Real Estate Market Stats – January 2026

This is the highest DOM reading we’ve seen in over a year, and it tells an important story about where the market is heading. The summer months were a different world homes were selling in just 28.6 days on average in July 2025. Since then, the trend has been steadily upward.

For sellers, this means pricing strategy matters more than ever. Overpriced listings are sitting longer, and buyers are less willing to rush into decisions. If you’re planning to list your home in Halifax-Dartmouth, working with an experienced agent who understands current pricing dynamics is critical.

For buyers, the extra time on market is a welcome change. You have more room to do your due diligence, negotiate conditions, and avoid the pressure of multiple-offer situations that dominated 2021–2023.

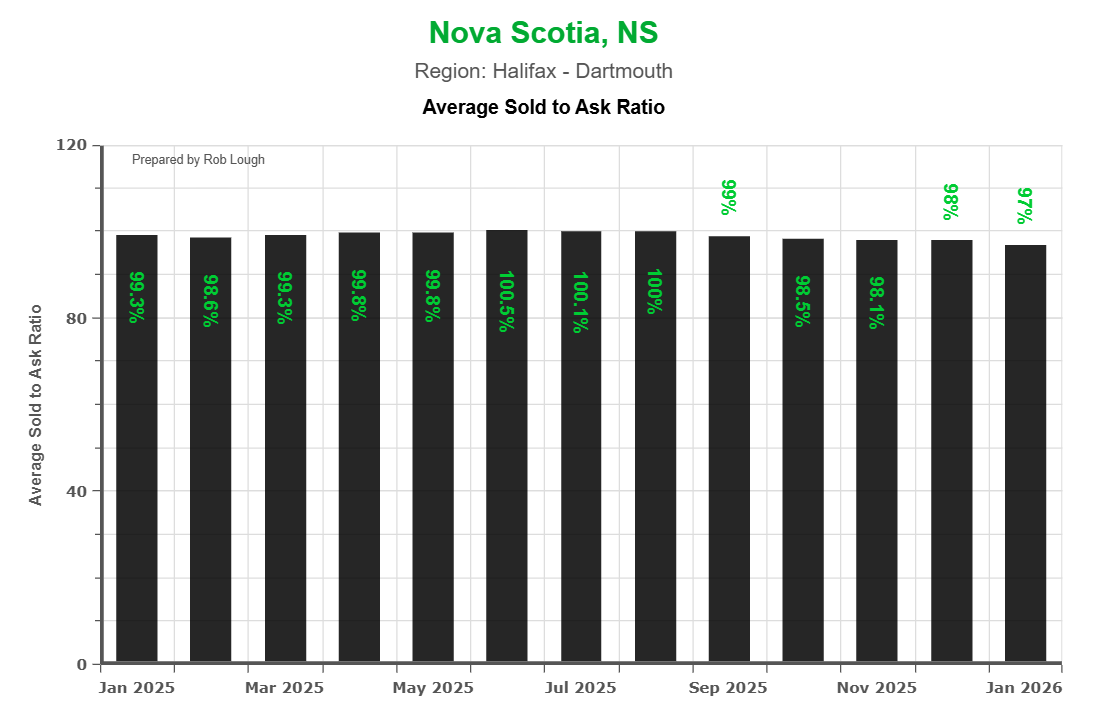

Sold-to-Ask Price Ratio: Buyers Gaining Leverage

The average sold-to-ask ratio dropped to 97% in January 2026 the lowest reading in the past 13 months. Compare that to 99.3% in January 2025 and the peaks of 100.1%–100.5% seen during the summer months when homes were routinely selling at or above asking price.

Average Sold to Ask Ratio Halifax-Dartmouth Real Estate Market Stats – January 2026

A ratio below 100% means buyers are negotiating below list price on average and at 97%, there’s meaningful room for negotiation. This is a significant shift from the summer when sellers held all the leverage.

For buyers, this is one of the strongest negotiating positions we’ve seen in a while. You’re more likely to secure a property below asking price, especially on listings that have been sitting for several weeks.

For sellers, realistic pricing from day one is the key to a successful sale. The days of testing the market with an inflated asking price and expecting a bidding war are behind us — at least for now. If you want more insight into how pricing power has evolved with policy changes and financing rules, see my article on new mortgage rules for 2024 & 2025.

What’s Driving These Trends?

Several factors are shaping the Halifax-Dartmouth market as we move into 2026.

The Bank of Canada held its overnight rate steady at 2.25% in late January, following a series of cuts that brought rates down from 5% over the course of 2024–2025. Most analysts expect rates to remain stable through much of 2026, which should provide a predictable borrowing environment for buyers. If you’re considering a purchase, getting pre-approved for a mortgage in the current rate environment is a smart move.

Inventory levels have been climbing. Total listings across Halifax increased 8.8% year-over-year in 2025, and that trend appears to be continuing into 2026. More choice for buyers means less urgency and more balanced negotiations; for a deeper look at how policy, supply, and development are interacting locally, you can read my pieces on HRM’s Suburban Housing Accelerator and property taxes in Nova Scotia.

Halifax’s population growth continues to fuel underlying demand. With a population exceeding 503,000 and strong immigration numbers, the fundamental need for housing in our region isn’t going anywhere. However, new construction and rising listings are helping to ease the supply crunch that defined the market in previous years.

The upcoming CUSMA (Canada-US-Mexico Agreement) review also looms as a wildcard for the broader Canadian economy, which could influence buyer confidence and economic conditions throughout 2026.

The Bottom Line for Buyers and Sellers

If you’re a buyer: January 2026 presents one of the best buying opportunities we’ve seen in Halifax-Dartmouth in several years. Homes are sitting longer, prices are negotiable, and interest rates are stable. The reduced competition in winter months means you can take your time and make smart decisions; to understand how to structure a smart purchase in this environment, my article on starting an Airbnb in Halifax is a good example of how to think strategically about investment properties and regulations.

If you’re a seller: The market hasn’t collapsed, prices are still up 3.9% year over year. But the pace has shifted, and your strategy needs to shift with it. Proper pricing, professional marketing, and patience are the keys to a successful sale right now. The spring market typically brings renewed buyer activity, so listings that come to market in the next few weeks are well-positioned to catch the early wave; if you’d like to see how my team approaches marketing and negotiation, take a look at Your Halifax Real Estate Success Story Starts Here.

Whether you’re buying or selling in the Halifax-Dartmouth area, understanding the numbers is the first step to making confident real estate decisions. If you’d like a personalized market analysis for your neighbourhood, don’t hesitate to reach out.

Related Resources

Rob Lough is a Broker/Owner and Realtor® with Century 21 Optimum Realty, serving Halifax Regional Municipality, East Hants, and Truro. With 25 years of experience in Nova Scotia real estate — including 20 years as a Realtor and 5 years as a Home Inspector — Rob brings a unique depth of knowledge to every transaction. Get in touch today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link