Canadian Mortgage Market Alert June 2025: How Rising Fixed Rates and BoC Policy Will Impact Your Home Financing

Updated: June 2025 | Reading Time: 5 minutes

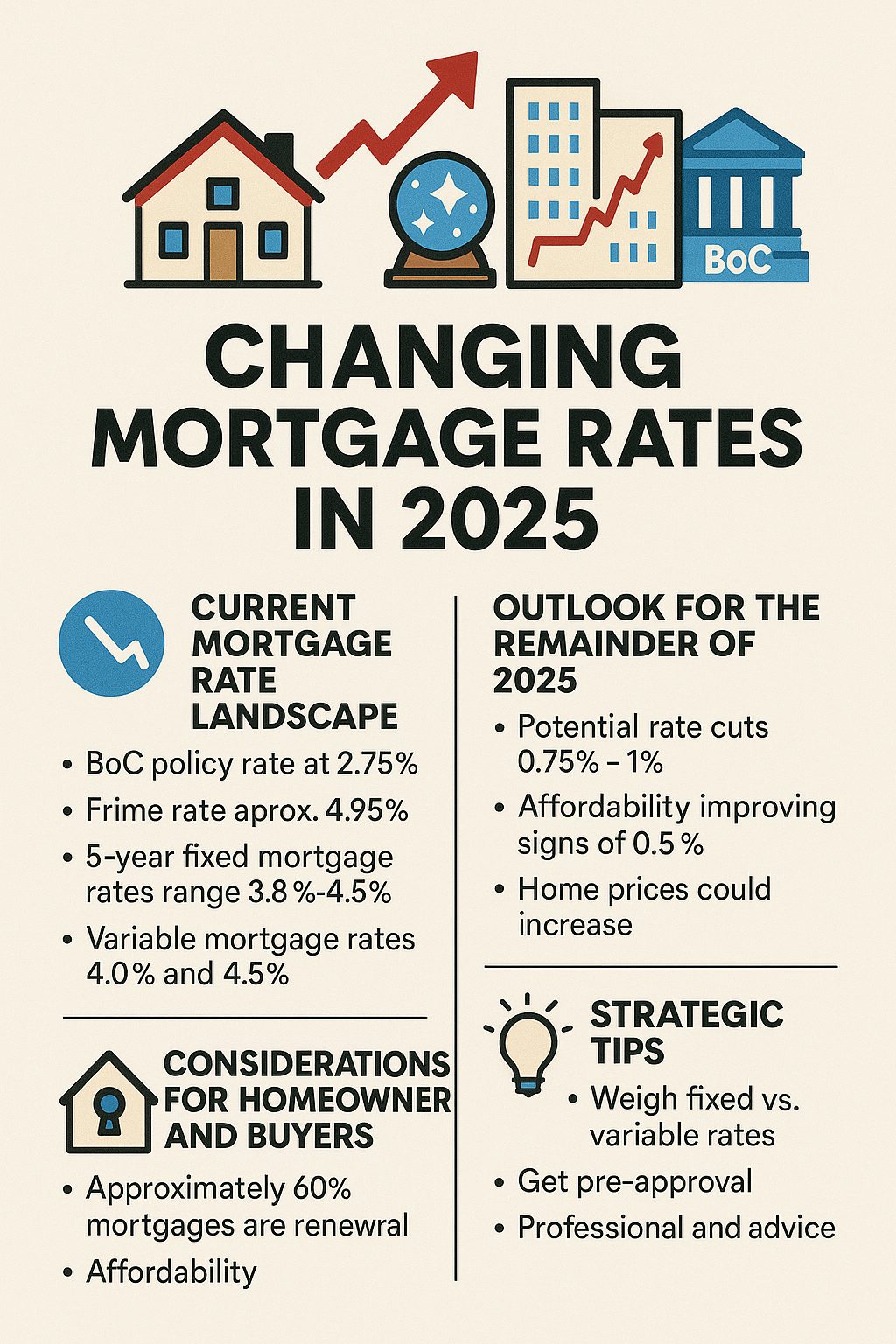

Fixed mortgage rates are climbing in Canada as the Bank of Canada weighs its next policy move. Discover how these changes affect your mortgage strategy and home buying plans. Canada’s mortgage market is experiencing a pivotal moment as financial institutions adjust their lending strategies and the Bank of Canada deliberates its next policy direction. For millions of Canadian homeowners and prospective buyers, these developments signal a shift that demands attention and strategic planning.

The New Reality: Fixed Mortgage Rates Climb Higher

Market Forces Drive Rate Increases

Canadian financial institutions are reversing course on the competitive rate environment that characterized recent months. This transformation reflects several converging factors:

Primary Rate Drivers:

- Bond market volatility pushing government yields higher

- International inflation pressures affecting global lending costs

- Lender risk reassessment following aggressive pricing periods

- Economic uncertainty prompting conservative lending approaches

The competitive rate wars that benefited borrowers throughout 2024 are giving way to a more conservative lending environment. Major banks and alternative lenders alike are recalibrating their mortgage pricing to reflect increased funding costs and market realities.

Borrower Impact Analysis

This rate environment creates immediate challenges for different borrower segments:

Renewal-Focused Borrowers face potentially significant payment increases when existing terms expire. Those accustomed to historically low rates may experience payment shock as renewal rates exceed current mortgage payments by substantial margins.

Purchase-Motivated Buyers encounter reduced purchasing power as higher rates translate directly into elevated monthly obligations. The same income now qualifies for smaller mortgage amounts, potentially requiring larger down payments or adjusted property expectations.

Bank of Canada Strategy: Measured Approach Continues

Economic Data Supports Rate Stability

Current economic indicators suggest the Bank of Canada will maintain its overnight rate at upcoming policy meetings. Key supporting factors include:

Economic Strength Indicators:

- GDP growth exceeding forecasted targets

- Employment resilience maintaining consumer confidence

- Controlled inflation metrics showing gradual improvement

- Stable financial system supporting monetary policy flexibility

This measured approach reflects the central bank’s preference for data-driven decisions rather than reactive policy changes. By maintaining current rates, the Bank provides stability while monitoring economic developments.

Policy Implications for Mortgage Holders

The Bank’s steady approach creates distinct outcomes for different mortgage products:

Variable-Rate Advantages become more pronounced as fixed rates rise while variable rates remain tied to the unchanged policy rate. This divergence creates opportunities for borrowers willing to accept rate uncertainty in exchange for current savings.

Fixed-Rate Considerations shift toward timing and term selection as borrowers weigh immediate rate security against potential future changes. The decision becomes more complex as the gap between fixed and variable rates widens.

Strategic Planning for Canadian Property Owners

Fixed Mortgage Renewal Strategies

Homeowners approaching mortgage renewal face critical decisions requiring careful analysis:

Early Renewal Assessment: Many lenders offer renewal opportunities 120-180 days before maturity. This option allows borrowers to secure current rates before potential increases, though it may involve penalty calculations for existing terms.

Lender Competition Analysis: Despite rising rates, significant differences exist between institutions. Shopping multiple lenders often reveals rate variations of 0.25% to 0.50%, representing substantial savings over mortgage terms.

Term Selection Considerations: The traditional five-year term may not suit all borrowers in the current environment. Shorter terms offer renewal flexibility, while longer terms provide extended rate protection.

Home Purchase Navigation

Prospective buyers must adapt strategies to address current market conditions:

Affordability Recalculation becomes essential as higher rates reduce qualifying amounts. Buyers should stress-test their finances using rates 1-2% above current offerings to ensure payment sustainability.

Down Payment Optimization gains importance as larger down payments reduce borrowing requirements and may qualify buyers for better rates. RRSP Home Buyers’ Plan utilization and family assistance programs merit consideration.

Market Timing Evaluation involves balancing current rate environments against future expectations. While rates may continue rising, waiting could result in further increases or reduced property selection.

Regional Market Dynamics and Predictions

Geographic Variations Expected

Canada’s diverse regional economies will experience different impacts from changing mortgage conditions:

Major Urban Centers like Toronto and Vancouver may see more pronounced cooling as higher rates compound existing affordability challenges. However, employment strength and population growth provide underlying support.

Secondary Markets across provinces may prove more resilient as lower baseline prices offer greater affordability buffers. Regional economic diversification also provides stability against rate-driven demand reductions.

Rural and Remote Areas face unique challenges as limited lending options may amplify rate increases. However, lower property values may offset some impact for local buyers.

Market Correction Possibilities

Housing market adjustments appear likely but may vary significantly by region and price segment:

- Price stabilization rather than dramatic declines in most markets

- Inventory normalization as buyer competition decreases

- Transaction volume reduction affecting real estate professionals

- First-time buyer challenges potentially requiring policy intervention

Professional Guidance and Decision-Making

Mortgage Broker Advantages

Current market complexity makes professional mortgage advice increasingly valuable:

Lender Access: Brokers maintain relationships with multiple institutions, providing access to rates and products unavailable to individual applicants. This network becomes crucial when rate shopping across numerous options.

Product Knowledge: Understanding mortgage features, penalties, and flexibility options requires expertise that most borrowers lack. Professional guidance helps navigate complex product comparisons.

Negotiation Power: Experienced brokers leverage volume relationships to secure better rates and terms than individual applicants typically achieve independently.

Financial Planning Integration

Mortgage decisions should align with broader financial strategies:

Cash Flow Management requires balancing mortgage payments against other financial goals including retirement savings, education funding, and emergency reserves.

Investment Considerations may favor mortgage acceleration versus alternative investments, depending on individual circumstances and risk tolerance.

Insurance Planning becomes more critical as larger mortgages increase family financial exposure requiring adequate life and disability coverage.

Future Outlook and Preparation Strategies

Economic Scenario Planning

Canadians should prepare for multiple potential outcomes:

Continued Rate Increases remain possible if inflation persists or economic growth accelerates beyond expectations. This scenario favors variable-rate conversion to fixed products and aggressive debt reduction strategies.

Rate Stabilization appears most likely given current economic indicators and Bank of Canada communications. This environment supports strategic mortgage shopping and selective market participation.

Economic Slowdown could prompt rate reductions, though this scenario involves broader economic challenges affecting employment and property values.

Personal Financial Readiness

Regardless of economic outcomes, individual preparation remains essential:

- Emergency fund maintenance covering 3-6 months of expenses including mortgage payments

- Debt reduction focus minimizing non-mortgage obligations to improve cash flow flexibility

- Income diversification reducing dependence on single employment sources

- Regular strategy review adapting to changing personal and economic circumstances

Conclusion: Adapting to Canada’s Evolving Mortgage Environment

Canada’s mortgage landscape reflects broader economic transitions requiring informed decision-making and strategic adaptation. While fixed rates climb and policy uncertainty persists, opportunities exist for prepared borrowers willing to navigate complexity.

Success in this environment demands staying informed about market developments, understanding personal financial capacity, and seeking professional guidance when needed. The mortgage decisions made today will influence financial outcomes for years to come, making careful consideration essential.

Canadian homeowners and buyers who approach these changes with knowledge, preparation, and professional support will find opportunities to optimize their mortgage strategies despite challenging market conditions.

Mortgage markets change rapidly. Consult with qualified professionals for personalized advice based on your specific financial situation and goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link