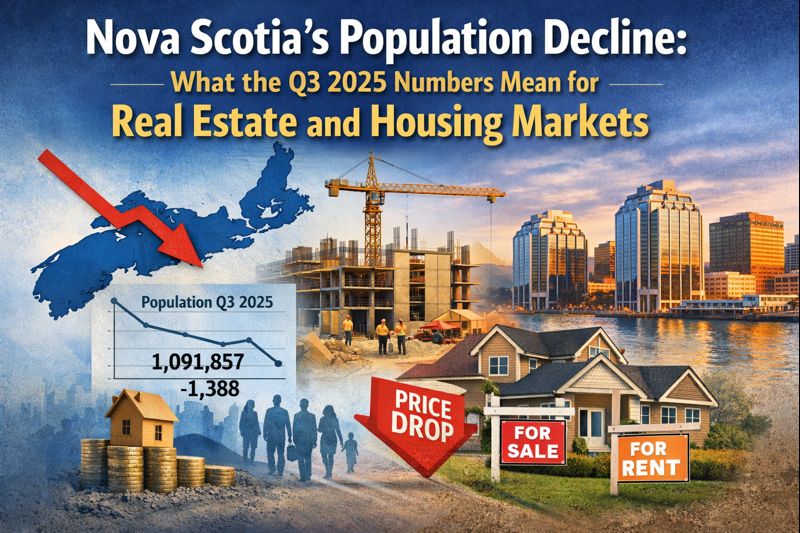

Nova Scotia’s Population Decline: What the Q3 2025 Numbers Mean for Real Estate and Housing Markets

Nova Scotia recorded its first quarterly population decline since 2020, signaling a potential turning point for the province’s housing markets after years of unprecedented growth.

Understanding the Population Shift

Statistics Canada estimates Nova Scotia’s population at 1,091,857 as of October 1, 2025, down 1,388 people from July 1. According to CBC News, this represents a 0.13% decline and marks the sharpest quarterly drop the province has seen in approximately a decade.

The decline comes after years of robust population growth that transformed Nova Scotia’s real estate landscape. Between July 1 and September 30, 2025, the province experienced its first quarterly population dip since the pandemic began, though the annual figures still show growth of 3,584 people (+0.33%) from October 2024 to September 2025.

For buyers: This shift may signal moderating competition in some market segments, particularly rental properties that had been in high demand from temporary residents.

For sellers: While the quarterly decline is notable, the year over year growth indicates continued overall demand, especially in markets attractive to permanent residents and interprovincial migrants.

What’s Driving the Population Change

The primary factor behind Nova Scotia’s population decline is a net loss of non permanent residents including international students and temporary foreign workers, linked to tighter federal immigration and permit policies implemented throughout 2025.

Natural population change tells a sobering demographic story. Deaths have exceeded births every quarter since 2016, and in Q3 2025 alone, there were 2,851 deaths compared to just 2,137 births, creating a natural decline of 714 people in a single quarter.

Permanent immigration and interprovincial migration remain positive forces, but they no longer offset the combination of fewer non permanent residents and ongoing natural decline as powerfully as they did during the 2021 to 2023 boom period.

The Broader Context: From Boom to Stabilization

Nova Scotia experienced extraordinary population growth from roughly 2020 through 2023. Pandemic era migration patterns brought Atlantic Canadians home, while strong international immigration created unprecedented demand for housing across Halifax Regional Municipality, Truro, and other markets. As detailed in our analysis of Halifax’s Suburban Housing Accelerator, the Halifax population reached 492,200 residents in 2023, growing by over 19,000 people (+4%).

Growth had already begun slowing in 2024 and early 2025. Provincial Finance documents showed much smaller contributions from non permanent residents, with annual growth rates decelerating to approximately 1% by mid 2025, still positive, but a fraction of the boom years.

The Q3 2025 decline reflects a national trend. Canada’s overall population fell by about 76,000 people (0.2%) in the same quarter, primarily because federal policy changes are reducing temporary residents and trimming permanent immigration targets for 2025 to 2026.

Economic and Fiscal Implications

An economics professor quoted in the CBC article emphasized that many public costs such as roads, parks, and infrastructure are fixed or slow to shrink. A smaller population can mean higher per capita costs, potentially requiring tax increases or service cuts to maintain fiscal balance. This concern is particularly relevant given current property tax structures in Nova Scotia, where municipal services rely heavily on property tax revenue.

Nova Scotia is already projecting a record deficit of approximately $1.2 billion. A slower growing or shrinking tax base could complicate fiscal planning and affect long term infrastructure commitments that impact housing development and municipal services.

In the labour market, the population dip may temporarily ease pressure on rental demand and service backlogs. However, a persistently aging, slow growing population can worsen worker shortages and strain healthcare systems over time, factors that directly influence quality of life and community attractiveness.

What This Means for Nova Scotia Real Estate Markets

Despite the quarterly decline, Nova Scotia’s population remains higher than a year earlier. This appears to be the end of an unsustainable surge rather than a market collapse.

The structural story is fundamentally demographic: ongoing natural decline combined with policy driven reductions in temporary residents. This isn’t a sudden loss of Nova Scotia’s attractiveness as a place to live. The province continues to attract permanent residents and interprovincial migrants who are often homebuyers rather than renters.

[Chart: Nova Scotia Quarterly Population Change 2020 to 2025]

Policy changes regarding immigration and student/work permits will be crucial in determining whether this represents a short term adjustment or the beginning of a longer period of flat or minimal growth. This distinction matters directly for housing demand, municipal tax bases, and infrastructure planning across Halifax, Truro, Cape Breton, and other markets.

For buyers: Markets that were particularly dependent on temporary resident demand (student housing areas, smaller rental units) may see more balanced conditions. Longer term homebuyer markets serving families and permanent residents should remain relatively stable. Consider working with professionals who understand closing costs when buying in Nova Scotia to budget appropriately.

For sellers: Understanding your property’s specific market segment is more important than ever. Properties appealing to permanent residents, families, and interprovincial migrants are positioned differently than those primarily serving temporary populations. For investors, new investment property mortgage rules taking effect in January 2026 add another layer of consideration.

Regional Market Considerations

Halifax Regional Municipality, which absorbed much of the province’s growth during the boom years, may experience the most noticeable impacts from reduced temporary resident numbers. University districts and areas with concentrated rental housing could see moderating demand. However, as reported in recent data, Halifax housing starts jumped 32% year over year, indicating continued development momentum despite population changes.

Markets like Truro, East Hants, and the Annapolis Valley that attracted permanent residents seeking affordability may prove more resilient, as policy changes affecting temporary residents have less direct impact on these buyer profiles.

Cape Breton and the South Shore, already dealing with aging demographics, may face continued challenges despite their appeal to retirees and lifestyle migrants.

Looking Ahead: What to Watch

Monitor federal immigration policy announcements for 2026 and beyond. Current temporary resident reductions are policy choices that could be adjusted based on labour market needs and economic conditions.

Track interprovincial migration patterns. If Nova Scotia continues attracting permanent residents from other provinces, particularly Ontario and Western Canada, this provides a more stable foundation for housing demand than temporary resident growth.

Watch natural change statistics. The ongoing gap between births and deaths represents a structural demographic challenge that makes the province increasingly dependent on migration for population stability.

Professional Guidance Matters

Whether you’re buying or selling in Nova Scotia’s evolving market, working with experienced local professionals provides crucial advantages. Understanding how population trends affect specific neighbourhoods and property types requires deep market knowledge and access to current data.

This analysis reflects information available as of December 2025, including Statistics Canada data and reporting by CBC News on Nova Scotia’s Q3 2025 population statistics.

About the Author

Rob Lough is a Broker/Owner/Realtor® at Century 21 Optimum Realty with 24 years of real estate experience serving Halifax Regional Municipality, East Hants, and Truro. His background as both a Realtor and former Home Inspector provides clients with comprehensive market insight and technical expertise.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link