Nova Scotia Passes the $200B Mark: What Rising Assessments Really Mean for Homeowners

Understanding property assessments, the CAP program, and what it all means for your tax bill

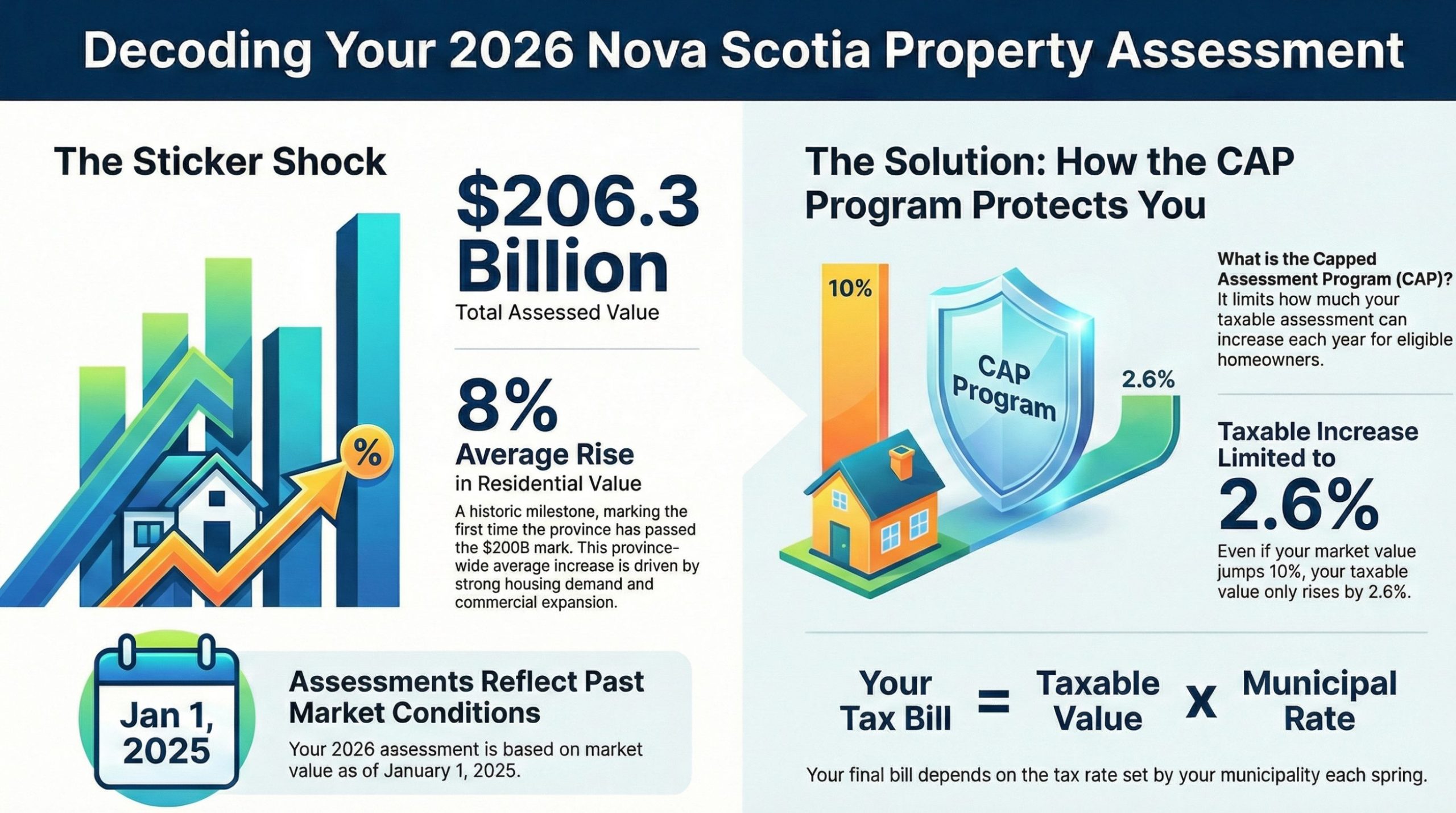

If you’ve opened your 2026 property assessment notice and felt a jolt of sticker shock, you’re not alone. Nova Scotia has officially crossed a historic threshold: the province’s total assessed property value now sits at approximately $206.3 billion, marking the first time the assessment roll has breached the $200 billion mark.

But here’s what many homeowners don’t realize: a big jump in your assessed value doesn’t automatically mean an equally big jump in your property tax bill. Thanks to Nova Scotia’s Capped Assessment Program (CAP), most owner-occupied homes are protected from dramatic tax increases—even when market values are climbing sharply.

In this article, we’ll break down what this milestone means for you, how assessments actually work, and why understanding the CAP could save you from unnecessary worry (and maybe even money).

The $200 Billion Milestone: What’s Driving Growth?

The Property Valuation Services Corporation (PVSC) reports that Nova Scotia’s 2026 assessment roll has reached about $206.3 billion—a roughly 8% increase over last year. This total includes approximately $174 billion in residential property and about $32.2 billion in commercial property.

Residential values are up an average of 8% province-wide, while commercial assessments have grown by approximately 6%.

What’s fueling this growth?

PVSC points to several market trends:

Strong demand for affordable housing options including manufactured homes, semi-detached properties, and multi-unit buildings has pushed values higher across these segments.

Industrial and commercial expansion in the Halifax Regional Municipality, with growth in industrial parks, vacant land development, and hospitality properties.

Tourism-driven appreciation in popular vacation areas where demand for short-term rentals and seasonal properties continues to climb.

It’s important to remember that these are average increases. Some neighborhoods have seen values jump 15% or more, while others have remained relatively flat depending on local market conditions.

How Property Assessments Are Actually Set

Many homeowners assume their assessment reflects what they could sell for today. That’s not quite right.

PVSC uses a process called mass appraisal to value groups of similar properties based on a specific snapshot in time. For your 2026 assessment, PVSC looked at market conditions as they existed on January 1, 2025, with the physical condition of your property recorded as of December 1, 2025.

Think of your assessment as an estimate of what your property would have sold for on that specific date—not a guaranteed sale price, and not necessarily what it’s worth right now in today’s market.

The appeal window is short

Assessment notices arrive in January, and property owners have until approximately February 12, 2026 to file an appeal if they believe their value is inaccurate or too high. If you think PVSC has the wrong square footage, counted a finished basement that’s actually unfinished, or valued your property significantly above comparable sales, the appeal deadline matters.

Understanding the Capped Assessment Program (CAP)

Here’s where things get interesting—and where many homeowners breathe a sigh of relief.

The Capped Assessment Program (CAP) is a provincial program that limits how much the taxable assessment on eligible residential and resource properties can increase each year, regardless of how much market values have actually climbed.

The CAP rate is tied to Nova Scotia’s Consumer Price Index. For 2026, the CAP is set at 2.6%, up from 1.5% last year.

Who qualifies for CAP protection?

About 72% of residential properties in Nova Scotia—representing over 416,000 accounts—qualify for the CAP. That means even if your market assessment shows a 10% or 15% increase, your taxable assessment (the number used to calculate your actual tax bill) can only rise by 2.6% this year.

Eligibility requirements include:

At least 50% ownership by a Nova Scotia resident

Residential property with fewer than four dwelling units, or qualifying resource property (including manufactured homes, co-ops, and residential portions of farms)

Owned for at least one year, with special provisions for family transfers and condos (which must be owner-occupied to qualify)

When does CAP reset?

The CAP usually resets when a property is sold to a non-family buyer. This means the new owner’s taxable assessment may jump immediately to full market value before future increases are capped again at the annual rate. This is a critical consideration for both buyers estimating future tax bills and sellers explaining carrying costs to potential purchasers.

Assessments vs. Actual Tax Bills: The Math That Matters

Your assessment notice shows a dollar value, but that’s only half the equation.

Your actual property tax bill is calculated as: Taxable Assessment × Municipal Tax Rate

Municipalities set their tax rates each spring based on their budgets and needs. This is where the real impact on your wallet is determined.

A practical example

Let’s say your uncapped market assessment increased by 10% this year, but you qualify for CAP protection at 2.6%. Your taxable value (the number used for tax calculations) only rises by 2.6%.

Now, what happens next depends entirely on your municipality:

If your municipality lowers its tax rate to offset growth in the overall tax base, your actual bill might increase by less than 2.6%, stay roughly the same, or even decrease slightly.

If your municipality raises its tax rate to fund new services or infrastructure, your bill could rise by more than 2.6%—even with CAP protection.

Non-capped properties feel the full impact

Owners of non-capped properties—including recent purchases, some rental properties, larger multi-unit buildings, and commercial properties—don’t have this buffer. Their taxable assessment reflects the full market increase, which means they’re more vulnerable to sharp tax bill increases when values climb quickly.

Practical Steps for Nova Scotia Homeowners

As a Realtor with two decades of experience in Nova Scotia’s housing market, I recommend these action steps:

Read your notice carefully

Look for both the “assessed value” (market estimate) and the “capped assessment” (taxable amount) on your notice. Don’t panic if the assessed value has jumped—focus on the capped figure if you qualify for CAP protection.

Verify the details

Check that PVSC has your property details correct: square footage, number of bedrooms and bathrooms, lot size, condition rating, and property classification. Errors happen, and catching them early can prevent years of overpayment. Compare PVSC’s data against recent sales of similar properties in your neighborhood.

Appeal if necessary

If something looks wrong or your value seems significantly out of line with comparable sales, contact PVSC or file an appeal before the February 12 deadline. You can find appeal forms and instructions on the PVSC website.

Budget for potential changes

Reach out to your municipality or consult with a financial advisor to estimate your likely tax bill based on historical rate decisions—especially important if your property isn’t under CAP or if you’ve made major improvements that could affect your assessment.

Understand the implications when buying or selling

For sellers: Be prepared to explain to buyers that purchasing your property will reset the CAP, potentially causing their taxable assessment to jump to full market value.

For buyers: Factor in the true tax impact when calculating affordability. A property with a current low tax bill due to CAP protection may cost significantly more in taxes once you own it. Getting pre-approved for a mortgage should include careful consideration of property tax obligations.

The Bottom Line

Nova Scotia’s $200 billion assessment milestone reflects a strong, growing real estate market—but it doesn’t necessarily mean your tax bill is about to skyrocket. The Capped Assessment Program provides meaningful protection for most homeowners, limiting taxable increases to 2.6% this year regardless of market volatility.

The key is understanding the difference between your assessed value and your taxable value, then monitoring what your municipality does with its tax rate when budget season arrives.

If you have questions about how assessments affect your specific property or need guidance navigating Nova Scotia’s real estate market, I’m here to help.

About the Author

Rob Lough is a Broker/Owner/Realtor® at Century 21 Optimum Realty with 25 years of experience in Nova Scotia real estate. Serving the Halifax Regional Municipality, East Hants, and Truro markets, Rob combines deep local market knowledge with practical advice for buyers, sellers, and homeowners.

Related Resources

Halifax-Dartmouth Real Estate Market Statistics 2025: Complete Year-End Analysis

District 104 Real Estate Analysis: What 2025 Data Reveals About Truro, Bible Hill, and Stewiacke

Why Getting Pre-Approved Is the Smartest First Step When Buying a Home in Halifax

Canadian Mortgage Delinquency Rates in 2025: What Borrowers Need to Know

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link