How Nova Scotia’s 2% Down Payment Program Makes Homeownership More Accessible

By Rob Lough, Broker/Owner at Century 21 Optimum Realty

For many Nova Scotians, the path to homeownership isn’t blocked by an inability to afford monthly mortgage payments, it’s the upfront cash requirement that keeps them renting. When you’re paying $2,000 or more in monthly rent, saving $25,000 for a down payment can feel impossible, even when you’re financially stable and ready to own.

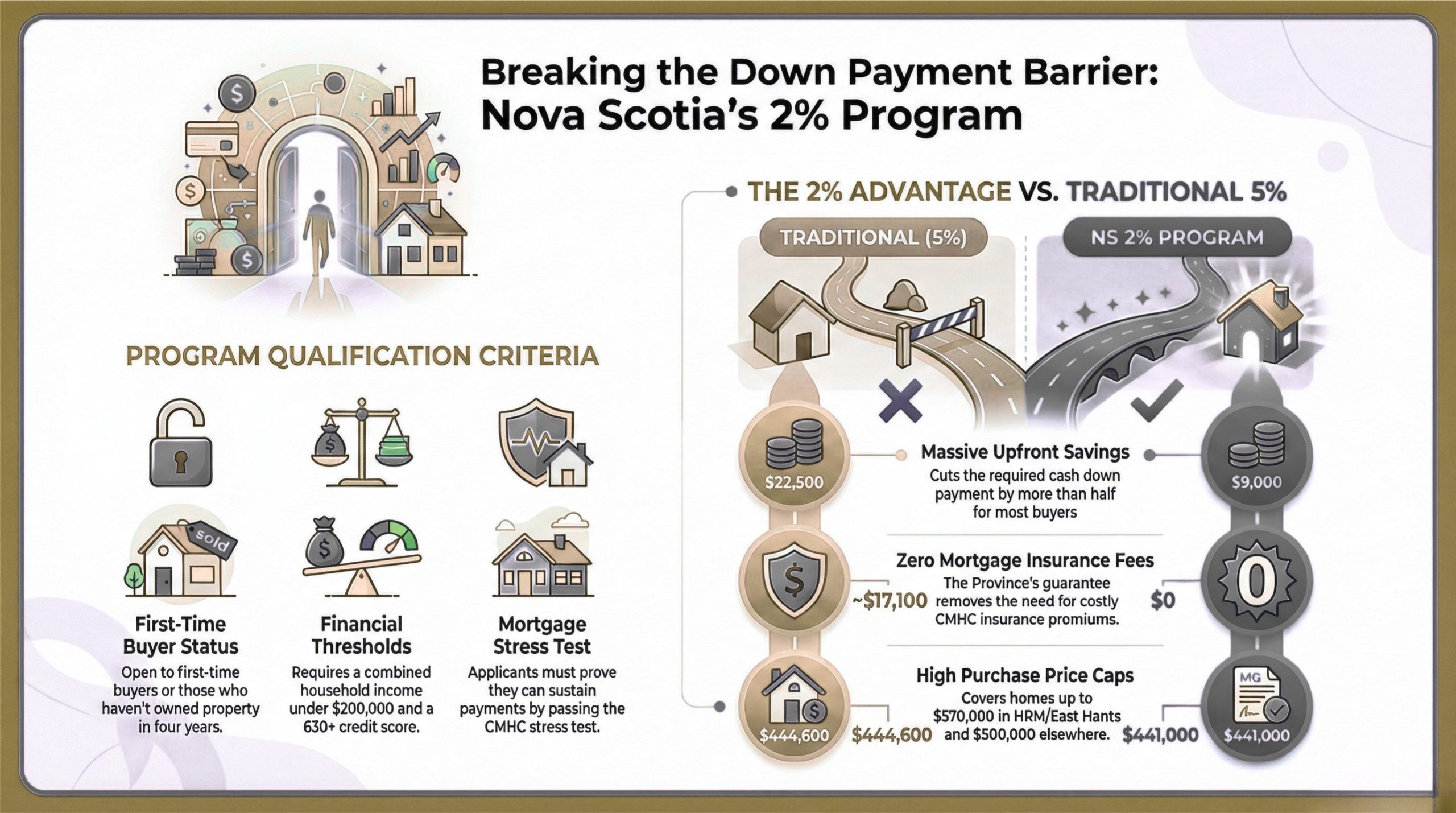

Nova Scotia’s new First-time Homebuyers Program addresses this exact challenge. This pilot initiative allows qualified buyers to purchase a home with just 2% down instead of the traditional 5%, with the Province stepping in to guarantee the mortgage and remove the need for costly default insurance.

Breaking Down the Barrier: 2% Instead of 5%

Traditional mortgage rules require first-time buyers to put down at least 5% on homes up to $500,000. On anything above that threshold up to $570,000, you need 5% on the first $500,000 plus 10% on the remainder. For a typical $500,000 home, that means coming up with $25,000 in cash.

The new program cuts that requirement by more than half.

Qualified buyers now need just 2% down—$10,000 on that same $500,000 home. The program applies to purchases up to $570,000 in HRM and East Hants, and up to $500,000 throughout the rest of the province.

What makes this work is the Province’s role as guarantor. If a borrower defaults and the home must be sold for less than the remaining mortgage balance, Nova Scotia covers 90% of the lender’s loss. This protection allows participating credit unions to offer mortgages without requiring traditional mortgage default insurance.

Who Can Take Advantage of This Program

The First-time Homebuyers Program is designed for people who are financially capable of homeownership but struggling to accumulate the traditional down payment while paying rent.

To qualify, you must meet these criteria:

-

Be a Nova Scotia resident and either buying your first home or haven’t owned property in at least four years

-

Have a combined household income under $200,000

-

Pass the CMHC mortgage stress test, proving you can handle the mortgage payments

-

Maintain a credit score of at least 630

-

Hold Canadian citizenship, permanent residency, or possess a sponsorship letter from a Nova Scotia provincial immigration program

-

If applying with a partner, you must have cohabitated for at least 12 months or be newly married

The income threshold and stress test ensure participants can sustain the monthly payments over time. This isn’t about making mortgages available to people who can’t afford them—it’s about removing the savings barrier for those who can.

Why This Program Eliminates Mortgage Insurance Costs

Here’s a significant advantage that sets this program apart: you won’t pay for CMHC mortgage default insurance.

Under normal circumstances, any mortgage with less than 20% down payment must be insured through CMHC or another approved provider. That insurance premium typically ranges from 2.8% to 4% of the mortgage amount and gets added directly to what you owe—or must be paid upfront.

The First-time Homebuyers Program eliminates this cost entirely. The Province’s guarantee to lenders serves the same protective function as mortgage insurance, but the buyer doesn’t bear the expense.

Program financing features:

-

Buyer contributes 2% down payment

-

Maximum interest rate set at prime plus 2%

-

Mortgages issued through credit unions across Nova Scotia

-

Administered by Atlantic Central on behalf of participating lenders

This structure makes the total cost of homeownership more affordable right from the start.

Comparing the Financial Impact: A Real Example

Consider what it actually takes to purchase a $450,000 home under both the traditional approach and this new program.

Standard 5% Down Payment:

-

Required down payment: $22,500

-

Approximate CMHC insurance premium: $17,100

-

Total mortgage amount: $444,600

-

Upfront cash needed: $22,500 plus closing costs

2% Down Payment Program:

-

Required down payment: $9,000

-

Mortgage insurance premium: $0

-

Total mortgage amount: $441,000

-

Upfront cash needed: $9,000 plus closing costs

That’s a difference of $13,500 in cash required at closing—money that could take years to save while renting in today’s Nova Scotia housing market.

The Policy Context: Part of a Larger Housing Strategy

This program didn’t emerge in isolation. It’s one component of the Province’s Our Homes, Action for Housing plan, which officials say has surpassed all initial targets and laid the groundwork for more than 68,000 new housing units in just two years.

Housing starts have jumped 36% over that period, demonstrating that supply is increasing. But the Province recognized that building more homes only solves half the equation. As the program announcement states, many renters are “struggling to save the down payment to buy a new home” despite being otherwise qualified.

Atlantic Central, which oversees program administration through the credit union network, describes eligible applicants as people who are “capable, responsible and ready for homeownership, but who need the right support to take that next step.”

The message is clear: this initiative targets the access gap, not the affordability gap. It’s built for people who can carry a mortgage but can’t accumulate the traditional down payment while managing current housing costs.

Important Considerations Before Applying

While the 2% down option opens doors for many buyers, it’s essential to understand whether it aligns with your financial situation and long-term goals.

This program may be ideal if:

-

You have steady income and solid credit but minimal savings

-

Rent consumes a large portion of your income, making it difficult to save

-

You can comfortably meet the stress test requirements

-

You’re committed to staying in Nova Scotia for the foreseeable future

You might want to consider alternatives if:

-

You’re within reach of saving a traditional 5% down payment

-

Your household income exceeds the $200,000 threshold

-

You don’t meet the residency or citizenship requirements

-

You’re uncomfortable carrying a mortgage close to the full purchase price

Remember that borrowing more means larger monthly payments and significantly more interest paid over 25 or 30 years. Make sure you’ve run the numbers and are confident in your ability to maintain those payments even if interest rates rise or your circumstances change.

Taking the Next Step

The First-time Homebuyers Program operates exclusively through participating credit unions in Nova Scotia. If you think this program might be right for you, reach out to a participating credit union to discuss your eligibility and start the mortgage pre-approval process.

You’ll need to provide standard documentation including proof of income, employment verification, details of your assets and debts, and authorization for a credit check. The credit union will evaluate whether you meet the program criteria and can pass the required stress test.

If you’d like professional guidance on how this program fits into your broader homebuying strategy, or if you need help navigating the Halifax real estate market and surrounding areas, I’m here to assist. With nearly a quarter-century of experience serving buyers throughout HRM, East Hants, and Truro, I can connect you with the right resources and help you make informed decisions.

To learn more about my background, approach, and client experiences, visit my home page or explore recent testimonials.

Rob Lough is a Broker/Owner and Realtor® with Century 21 Optimum Realty, serving Halifax Regional Municipality, East Hants, and Truro. With 25 years of experience in Nova Scotia real estate — including 20 years as a Realtor and 5 years as a Home Inspector — Rob brings a unique depth of knowledge to every transaction. Get in touch today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link