-

First-Time Buyers in Canada Face a Tougher Climb Than Past Generations

By Rob Lough, Broker/Owner, Century 21 Optimum Realty | Nova Scotia Real Estate

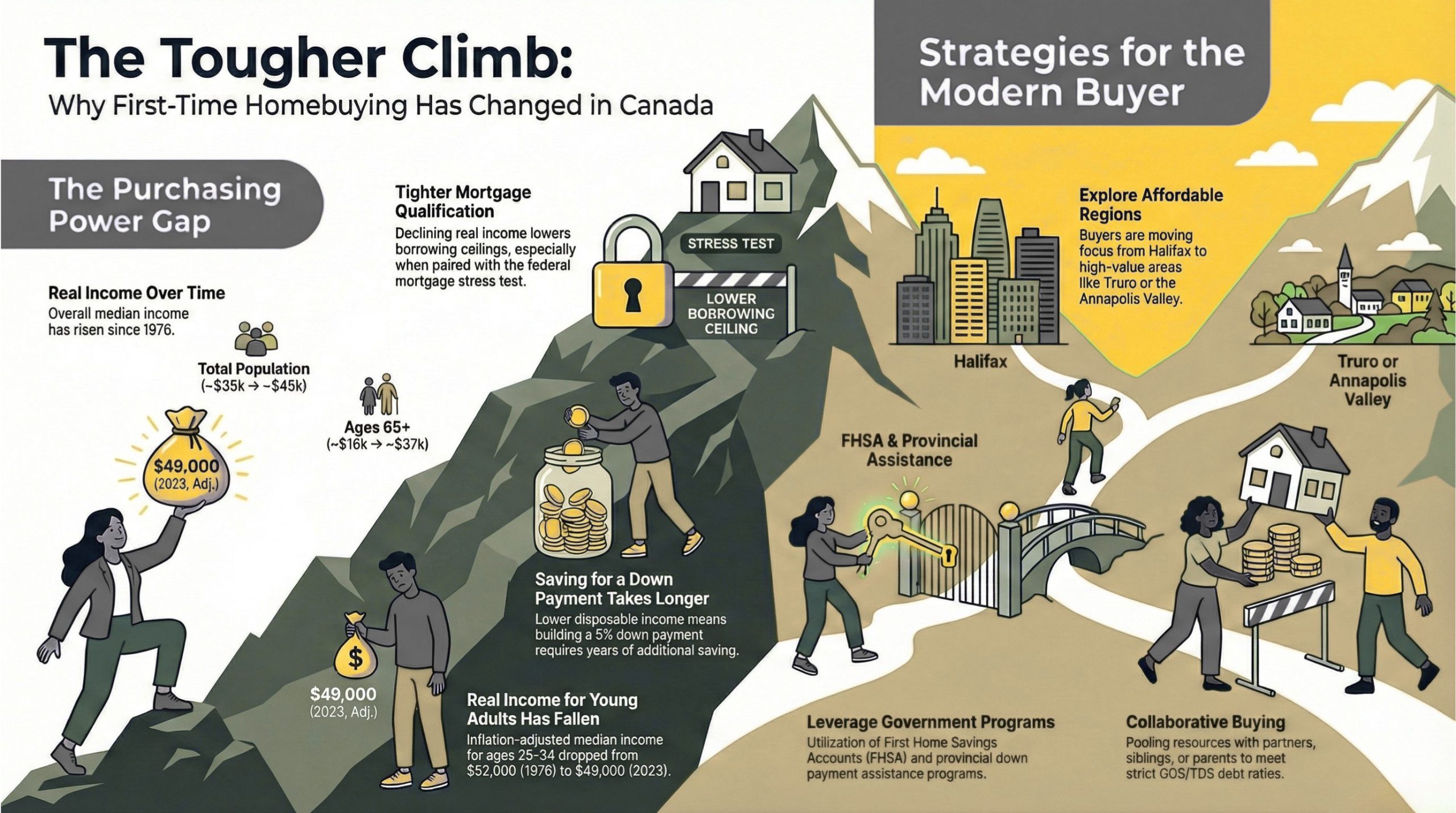

If you’re a young Canadian trying to break into the housing market, you’re not imagining things. It really is harder than it used to be. While previous generations could often transition from renting to owning in their mid-to-late twenties, today’s first-time buyers face a very different financial landscape.

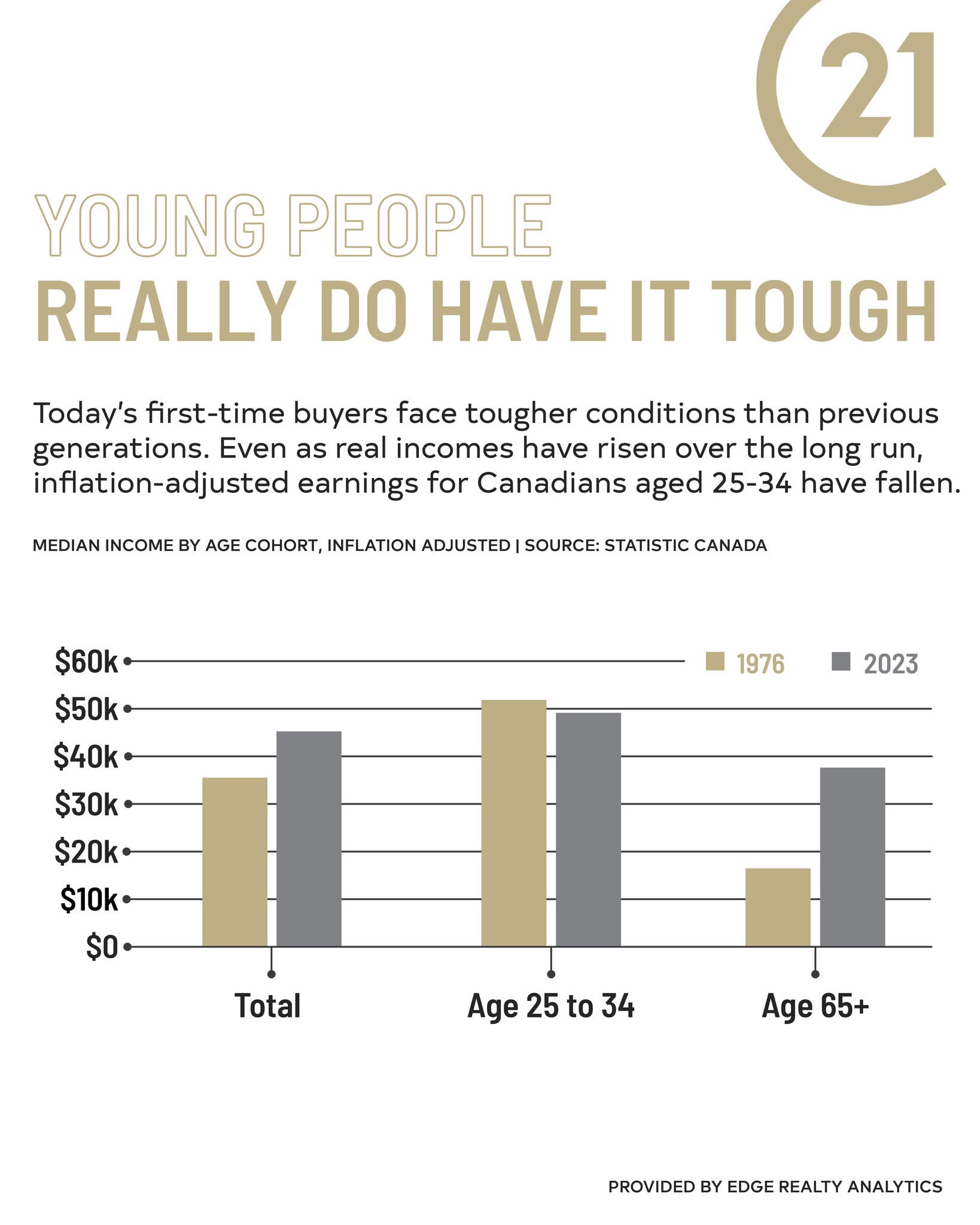

The data backs it up. According to Statistics Canada, inflation-adjusted median income for Canadians aged 25 to 34 has actually declined since 1976, even as overall median income across all age groups has risen. That means the generation most likely to be shopping for their first home is earning less in real terms than their parents did at the same age.

What the Numbers Show

Data from Statistics Canada comparing 1976 and 2023 inflation-adjusted median incomes reveals a striking pattern:

Total population (all ages): Median income rose from roughly $35,000 to $45,000, a healthy increase over nearly five decades.

Age 25 to 34: Median income dropped from approximately $52,000 to $49,000. This is the prime first-time buyer demographic, and their purchasing power has moved in the wrong direction.

Age 65+: Median income more than doubled, rising from roughly $16,000 to $37,000, reflecting better retirement benefits and longer working careers.

[Chart Placeholder: Bar chart comparing 1976 vs. 2023 inflation-adjusted median income by age cohort, Total, Age 25 to 34, Age 65+ | Source: Statistics Canada]

The takeaway is clear: while Canadians overall are earning more in real terms, the youngest working adults, the ones trying to save for down payments, are actually earning less.

Why This Matters for First-Time Buyers

Lower real earnings hit first-time buyers in two critical ways.

First-Time Buyers in Canada Face a Tougher Climb Than Past Generations

Saving for a down payment takes longer. With less disposable income after rent, groceries, and student loan payments, building up a down payment of even 5% can take years longer than it did for previous generations. In many Nova Scotia markets, the minimum down payment on a median-priced home still represents many months of aggressive saving for a young household. For a full breakdown of what to budget beyond your down payment, check out Closing Costs When Buying in Nova Scotia.

Mortgage qualification is tighter. Lenders use gross debt service (GDS) and total debt service (TDS) ratios to determine how much you can borrow. When your real income is lower, your borrowing ceiling drops, even if interest rates are reasonable. Add the federal stress test on top of that, and many young buyers find they qualify for less home than they expected. If you want to understand exactly how these ratios work, read our guide on GDS vs TDS Ratios: Your Complete Guide to Canadian Mortgage Qualification.

What Young Buyers Are Doing About It

Despite the challenges, young Canadians aren’t giving up on homeownership. They’re adapting. Here are some of the most common strategies I’m seeing in the Nova Scotia market:

Exploring more affordable regions. Halifax’s price growth over the past five years has pushed some buyers to look at communities like Truro, the South Shore, or the Annapolis Valley, where home prices remain significantly lower. In many of these areas, a well-maintained three-bedroom home is still attainable for buyers who might be priced out of HRM. For a closer look at what’s happening outside the city, see our District 104 Real Estate Analysis covering Truro, Bible Hill, and Stewiacke.

Using government programs. Programs like the First Home Savings Account (FHSA), the federal First-Time Home Buyer Incentive, and Nova Scotia’s 2% Down Payment Program can help bridge the gap. If you’re not already taking advantage of these, they’re worth exploring with a qualified mortgage professional.

Co-buying with family or partners. Pooling resources with a partner, sibling, or parent is becoming more common. It’s not the path everyone wants to take, but it can make the math work when a single income falls short.

Starting with a starter home. Rather than waiting for the “perfect” home, many first-time buyers are prioritizing getting into the market, even if that means a condo, a smaller home, or a property that needs a little work. Building equity now means being better positioned for a future move-up purchase.

For Sellers: Understanding Today’s Buyer Pool

If you’re selling a home in Nova Scotia, this data matters to you too. The buyer pool for entry-level and mid-range homes is increasingly made up of young buyers who are stretching to qualify. That means pricing your home competitively, presenting it well, and being open to flexibility on things like closing dates can make a real difference in how quickly your home sells and for how much.

Homes priced in the sweet spot for first-time buyers, roughly $250,000 to $400,000 in many Nova Scotia markets, continue to see strong demand. If your property falls in that range, you’re positioned well, but only if buyers can see the value.

The Bottom Line

Today’s first-time buyers are navigating a market that is fundamentally tougher than what their parents faced. Inflation-adjusted incomes for the 25 to 34 age group have fallen, housing costs have risen, and qualification rules have tightened. But with the right strategy, the right guidance, and a realistic plan, homeownership is still within reach for many young Canadians, especially in markets like Nova Scotia where relative affordability still exists compared to much of the country.

If you’re a first-time buyer trying to figure out your next move, or a seller wondering how to position your home for today’s market, reach out for a no-obligation conversation. Rob Lough is a Broker/Owner and Realtor® with Century 21 Optimum Realty, serving Halifax Regional Municipality, East Hants, and Truro. With 25 years of experience in Nova Scotia real estate — including 20 years as a Realtor and 5 years as a Home Inspector — Rob brings a unique depth of knowledge to every transaction. Get in touch today.

Related Resources

- How Nova Scotia’s 2% Down Payment Program Makes Homeownership More Accessible

- Why Getting Pre-Approved Is the Smartest First Step When Buying a Home in Halifax

- Closing Costs When Buying in Nova Scotia

- GDS vs TDS Ratios: Your Complete Guide to Canadian Mortgage Qualification

- Halifax-Dartmouth Real Estate Market Statistics 2025

- District 104 Real Estate Analysis: Truro, Bible Hill, and Stewiacke

- Nova Scotia’s Housing Affordability Crisis

First-Time Buyers in Canada Face a Tougher Climb Than Past Generations

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link