What Happens to a House When Someone Dies in Nova Scotia? Probate, Executors, and Selling the Estate Home

Losing a loved one is never easy. Along with grief comes the overwhelming task of managing their estate, including deciding what happens to their home. If you’re facing this situation in Nova Scotia, you’re probably wondering about probate, who has the legal authority to sell the property, and how long the process takes.

This guide walks you through what happens to a house when someone dies in Nova Scotia, explains the probate process in plain language, and helps you understand the practical steps for selling an estate home.

Understanding Probate Court in Nova Scotia

Probate Court in Nova Scotia serves an important role when someone passes away. The court appoints the executor or administrator, oversees how the estate is handled, and protects the interests of both heirs and creditors.

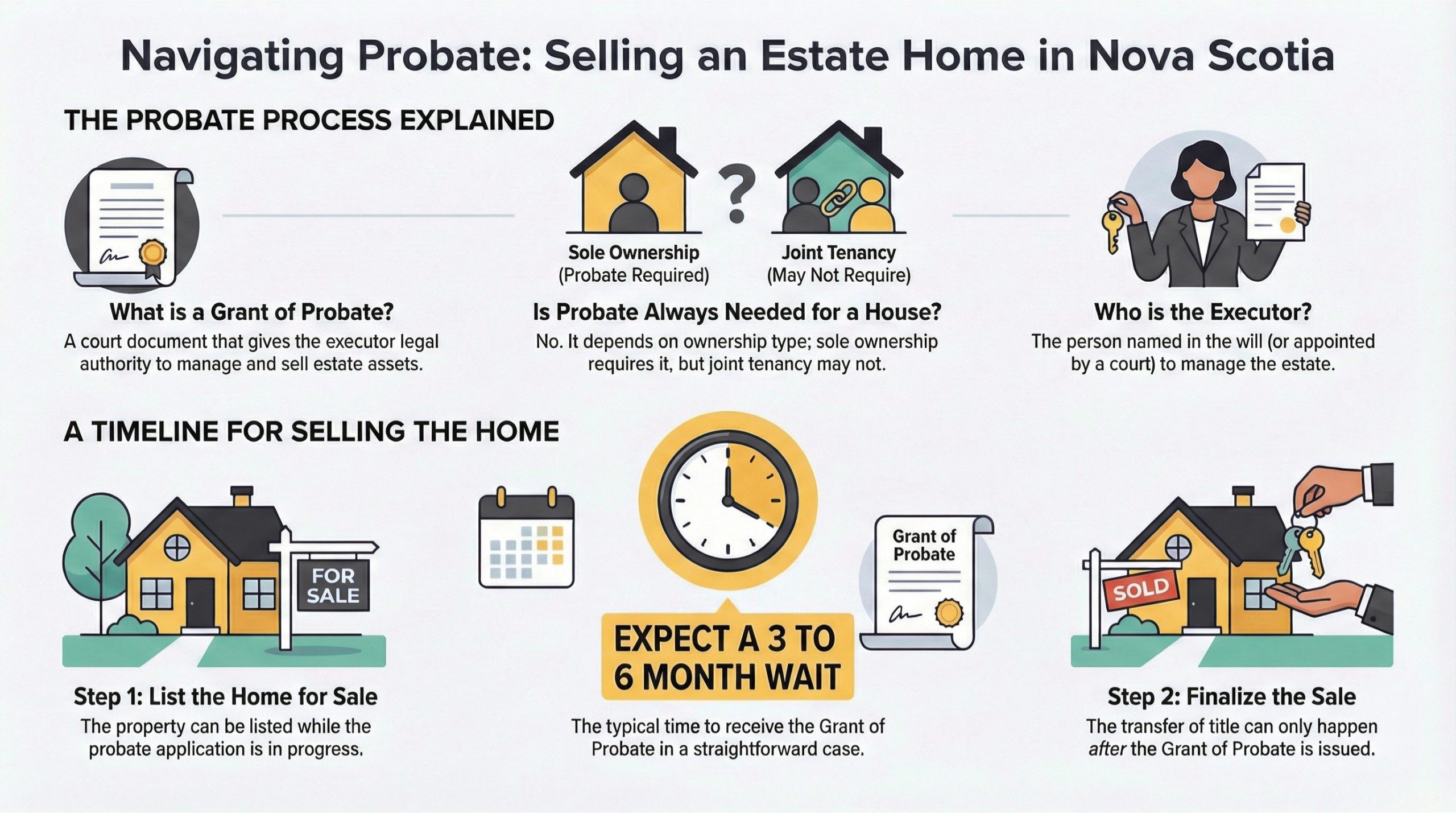

Before the estate can sell a house that was only in the deceased’s name, the court usually needs to issue a Grant of Probate confirming who is legally allowed to sign the paperwork. This document gives the executor the power to deal with real estate and other assets.

The probate process ensures that debts are paid, taxes are settled, and remaining assets are distributed according to the will or, if there’s no will, according to Nova Scotia’s intestacy laws.

Who Is the Executor and What Can They Do?

The executor, also called a personal representative, is the person named in the will to manage the estate. If there’s no will, the court appoints an administrator to fill this role, usually a close family member.

The executor has legal authority to manage estate assets, including selling the home if needed. However, this authority isn’t automatic. The executor must apply to Probate Court and receive a Grant of Probate (with a will) or Grant of Administration (without a will) before they can legally transfer or sell real estate.

Once the Grant is issued, the executor can make decisions about the property, pay estate debts, and distribute what remains to beneficiaries.

Does the House Always Need to Go Through Probate?

Not always. Whether probate is required depends on how the property was owned.

Sole ownership: If the home was in the deceased’s name only, that property must go through probate before it can be transferred or sold. The Land Registry needs to see the Grant of Probate to confirm who has legal authority to sign documents.

Joint tenancy with right of survivorship: When a property is held in true joint tenancy with right of survivorship, the deceased’s share usually passes automatically to the surviving joint owner. That specific property may not need probate, though other estate assets might still require it.

Tenants-in-common: If the deceased owned the property as tenants-in-common, their share forms part of the estate and typically requires probate. The executor needs estate authority to sell or transfer that interest.

Understanding how the property was titled is the first step in determining whether probate is necessary for the house.

The Probate Process for a House in the Deceased’s Name

When a house was owned solely by the deceased, here’s what usually happens in Nova Scotia:

Confirm the Will and Identify Who’s in Charge

The first step is locating the will to see who is named as executor. If there’s no will, a family member will apply to become the estate’s administrator.

The person taking on this role should meet with an estate lawyer right away. The lawyer can confirm what’s required and whether security, also called a bond, is needed. Security is more common when there’s no will or when the executor lives outside Nova Scotia.

Apply to Probate Court

The executor or administrator completes Probate Court forms, files the original will (if one exists), provides the death certificate, prepares an inventory of assets, and pays probate tax. They then attend an appointment at the court office.

Once the court is satisfied with the application, it issues a Grant of Probate or Grant of Administration. This formal document gives legal authority to manage and eventually sell the property.

Executor’s Authority to Sell Real Estate

Nova Scotia’s Probate Act allows the personal representative to sell real property to pay estate debts and to distribute assets among those entitled. The executor must follow any directions in the will.

If the sale is purely for distribution and not to pay debts, the Act sets out rules on beneficiary concurrence. In some cases, the executor may need a court order approving the sale to protect beneficiaries.

Can the Home Be Sold During Probate?

In most cases, yes. The property can be listed and even sold while probate is in progress, as long as the sale is carried out by the executor and follows the will and Probate Act.

However, the actual transfer of title at closing usually must wait until the Grant is issued. The buyer’s lawyer and the Land Registry need proof that the executor has legal authority to complete the transaction.

Dealing with Beneficiaries and Minors

Beneficiaries should be kept informed throughout the process. When the will doesn’t clearly authorize a sale, or when there are minors or beneficiaries who disagree, the executor may need court approval.

The Probate Court ensures that decisions about estate property are fair and protect the interests of heirs and creditors, especially when disputes arise.

After the Sale

Sale proceeds go into the estate account. The executor uses these funds to pay debts, taxes, and final expenses. What remains is distributed to beneficiaries according to the will or intestacy rules.

The executor eventually prepares accounts for approval by beneficiaries or the court, then closes the estate once all obligations are met.

What to Expect: Practical Timeline and Advice

Probate takes time. In a straightforward, uncontested estate, expect the process to take several months, not weeks. Closing dates for estate home sales should account for this timeline.

For sellers (executors):

Many executors list the home once they’re clearly identified and have started the probate application. This allows the property to be marketed while waiting for court approval.

It’s common to include an agreement clause making the sale conditional on the Grant of Probate or Administration being received by a certain date. This protects both the buyer and executor by setting clear expectations.

For buyers:

If you’re considering purchasing an estate property, understand that closing may be delayed while probate is completed. Your lawyer will ensure the executor has proper legal authority before finalizing the transaction. Understanding closing costs when buying in Nova Scotia can help you prepare financially for the purchase.

Who Should You Talk To?

Navigating an estate and selling a home during probate involves both legal and real estate expertise.

Speak with an estate lawyer for advice on probate requirements, beneficiary rights, and whether court approval is needed for the sale. They can guide you through the paperwork and ensure you’re meeting your legal obligations.

Work with a Realtor experienced in estate sales who understands probate timelines. They can help with pricing, preparing, and marketing the home while coordinating around court deadlines. Getting pre-approved for a mortgage may also be helpful if you’re a beneficiary considering purchasing the estate property.

Frequently Asked Questions

Can we live in the house during probate?

It depends on the circumstances. If a beneficiary was already living in the home or the will grants someone the right to remain, they may be able to stay. The executor should get legal advice to ensure any arrangement is proper and documented, especially if estate debts need to be paid.

Who pays the bills while we wait for probate?

The executor is responsible for maintaining the property and paying ongoing expenses like utilities, property taxes, and insurance from estate funds. These costs are considered estate debts and are paid before distributions to beneficiaries.

How long does probate usually take in Nova Scotia?

A straightforward, uncontested estate typically takes three to six months from application to receiving the Grant. Complex estates with disputes, out-of-province assets, or unclear wills can take much longer.

Do all estate homes need to be sold?

No. The executor only sells the home if required to pay debts, if the will directs a sale, or if beneficiaries agree it’s the best option. Sometimes property is transferred directly to a beneficiary instead.

What if the mortgage isn’t paid off?

The executor must continue making mortgage payments from estate funds to avoid default. At closing, the mortgage is paid from sale proceeds just like any other home sale. If the estate can’t afford payments, the executor should get legal advice immediately.

By Rob Lough, Broker/Owner/Realtor®

Century 21 Optimum Realty | Serving Halifax, East Hants & Truro

With 25 years of Nova Scotia real estate experience, including 20 years as a Realtor®, I help families navigate estate sales and probate with clarity and compassion.

Related Resources

- GDS vs TDS Ratios: Your Complete Guide to Canadian Mortgage Qualification

- Protecting Your Nova Scotia Home Purchase with Title Insurance

- Why Getting Pre-Approved Is the Smartest First Step When Buying a Home in Halifax

- First-Time Home Buyer Benefits After Separation in Nova Scotia

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link